The methods available for loan collections are just as diverse as the borrowers themselves. One method that stands out for its reliability and directness is Direct Debit.

This payment method, accessible to lenders, facilitates the seamless payments from a customer’s account.

In this article, we delve into the essence of Direct Debit, its advantages over card payments, and its implementation through Lendsqr.

Understanding Direct Debit

Direct Debit streamlines the loan collection process by allowing lenders to effortlessly collect funds directly from a borrower’s account at the designated time. The borrower’s active role begins during the loan application, where they grant authorization through what’s referred to as a mandate.

This mandate is required to be approved by their bank. This guarantees a seamless and secure transfer of funds, ultimately serving the best interests of both lenders and borrowers.

Why Direct Debit Shines Over Card Payments

This method offers a range of benefits, particularly when compared to card payments. While card payments are subject to potential issues like card deactivation or being flagged as stolen, it operates on a more consistent and dependable basis.

It eliminates the possibility of borrowers intentionally or unintentionally blocking transactions, ensuring a smoother repayment process.

Lendsqr’s Direct Debit

Lendsqr supports Direct Debit through NIBSS, providing lenders with a reliable and efficient framework for loan collections.

Direct Debit by NIBSS

With NIBSS Direct Debit, borrowers provide their bank account information during the loan application process. They then receive an email containing a link to digitally authorize the mandate using their signature.

Once initiated, the mandate enters the “Pending mandate activation” stage and is automatically sent to the bank for approval without requiring the borrower to be physically present. After bank authorization, the mandate proceeds to lender approval.

NIBSS e-Mandate

NIBSS also offers a more recent authorization approach known as e-Mandate. For e-Mandates, borrowers self-activate their mandate by transferring a small amount (₦50 for most banks) to a designated NIBSS e-Mandate activation account.

Upon successful transfer, the mandate is activated—often within hours—and is ready for debit operations.

Empowering Lenders and Borrowers

Direct Debit is more than just a payment method; it’s a bridge connecting the interests of both lenders and borrowers.

It offers lenders a reliable and consistent way to collect loan payments, while borrowers benefit from a seamless and secure process that aligns with their financial commitments.

Loan repayments

To use this feature, lenders simply need to set the loan to require direct debit as a repayment method. During the loan application process, the borrower will be prompted to create a direct debit mandate or add an existing one.

A mandate is a formal agreement between the borrower and the lender, allowing the lender to directly withdraw funds from the borrower’s bank account for loan repayments.

This process simplifies the repayment process, reduces the chance of missed payments, and allows for consistent, timely payments.

Scheduled Payments

It can be used as a means to receive scheduled payments, this ranges from recurring subscription to future expected payments.

The lender just needs to create a mandate invite for the user and the customers will then get an SMS to activate their mandate.

In setting up a mandate for a user via Invite or manual upload, the lender has the options to use the manual or electronic mandate.

Manual activation: The mandate is automatically sent to the bank for activation without having the borrower be physically present. This is typically approved within 1 to 48 hours and can be debited immediately after bank approval.

Electronic activation: The user receives an SMS on how to activate the mandate, they initiate a transfer from the account on the mandate to the provided account. This is typically approved instantly and can be debited within 2 hours after approval.

To use Direct Debit via API, please see article on integration.

Receiving Payments with Direct Debit

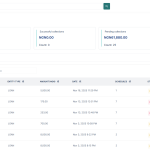

Collections from direct debit are settled alongside lender’s settlement on a T+1 basis, the reports can be gotten from the Lendsqr admin console.