Introduction

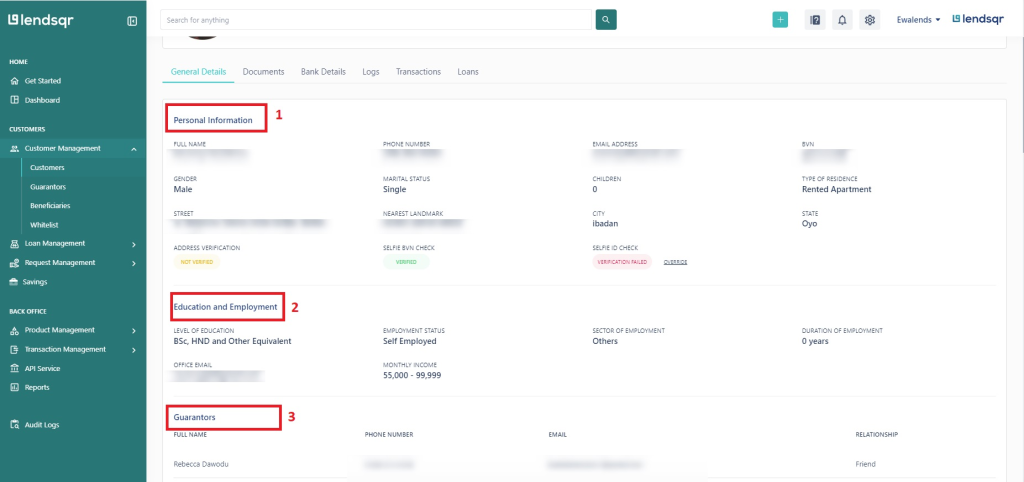

When managing customers on Lendsqr, it’s important to review their background and identity information before making lending decisions. To view users’ general details, a section exists on a user’s profile which provides a quick snapshot of their personal, financial, and guarantor-related information.

Step-by-step guide

- Navigate to the Customer Management section on the admin console.

- Click on a customer profile to open the details page.

- Select the General Details tab. Here, you’ll find three subsections:

1. Personal Information

This includes:

- Phone number

- Email address

- Gender

- Marital status

- Number of children

2. Education and Employment

This section provides:

- Highest level of education

- Employment status

- Office email

- Monthly income

3. Guarantors

This contains a list of loan guarantors tied to the user. It’s especially useful for risk assessment and understanding fallback repayment options.

By reviewing the General Details tab, you can better understand your customer’s background, earning potential, and risk profile, all in one place.

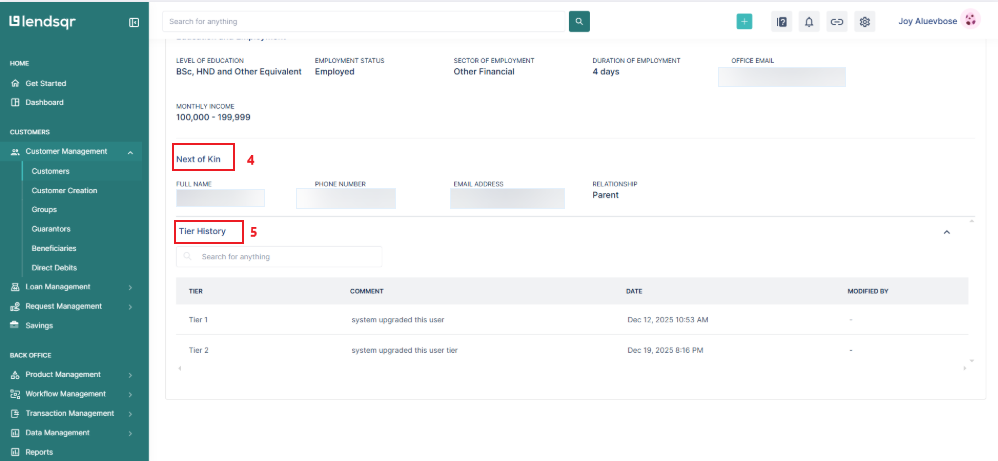

4. Next of kin

This contains details about a user’s next of kin. They help confirm a customer’s identity and assist if we need urgent communication. It includes:

- Full name

- Phone Number

- Email Address

- Relationship

5. Tier history

This contains information about a customer’s different tier levels at various points in time. It also indicates who upgraded the user’s tier level and when the upgrade occurred.Learn how to activate required documents here.

Read further: How to spot risky loan guarantors and protect yourself as a lender