The whitelist is a key feature in Lendsqr’s admin console, found under the “Customer management” tab on the sidebar. It allows you to create exclusive loan products for selected users by entering their BVN, phone number, or email. Only users you link to a whitelisted product can view or apply for it through your app.

For instance, you might partner with a company to offer its staff loans at discounted rates not available to the public. You can instantly assign this product to the company’s employees for seamless, private access.

Likewise, you can run loyalty promotions by whitelisting good borrowers and offering them better terms or new products. Bulk whitelisting these borrowers can be done to appreciate their reliability and strengthen user retention.

Finally, if you vet a specific user manually, use the single-entry option to whitelist them for custom loan access. This flexibility helps lenders serve different user groups without changing the entire loan catalog.

Creating a whitelist

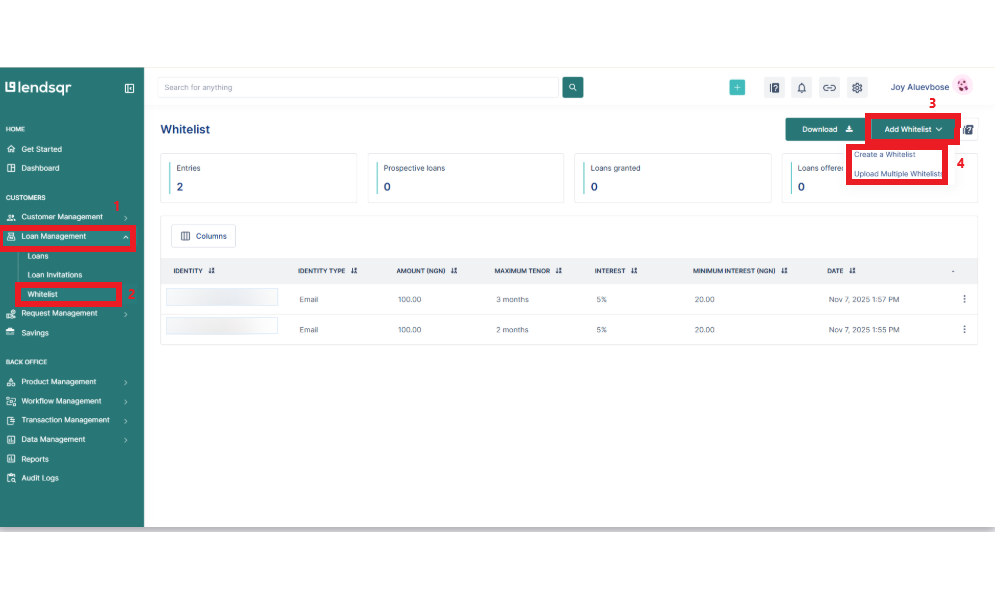

There are two ways to create a whitelist on the admin console. An admin can either create a single entry or multiple entries depending on the use case

To create a whitelist on the Lendsqr admin console, you can follow the steps below:

- Navigate to the “Whitelist” sub-tab under the “Loan management” tab.

- Click on the “Add whitelist” button. This will show you a dropdown with the option to Create an Entry for single entries or Create Multiple for multiple entries.

Read also: 7 types of loan management software in 2025