This section allows platform administrators to control the specific documents required from borrowers during onboarding or throughout the lending lifecycle.

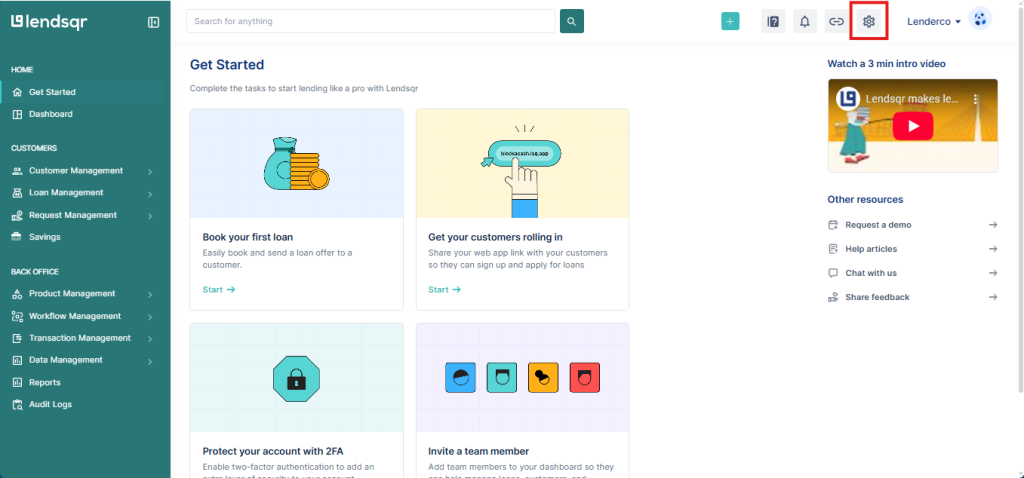

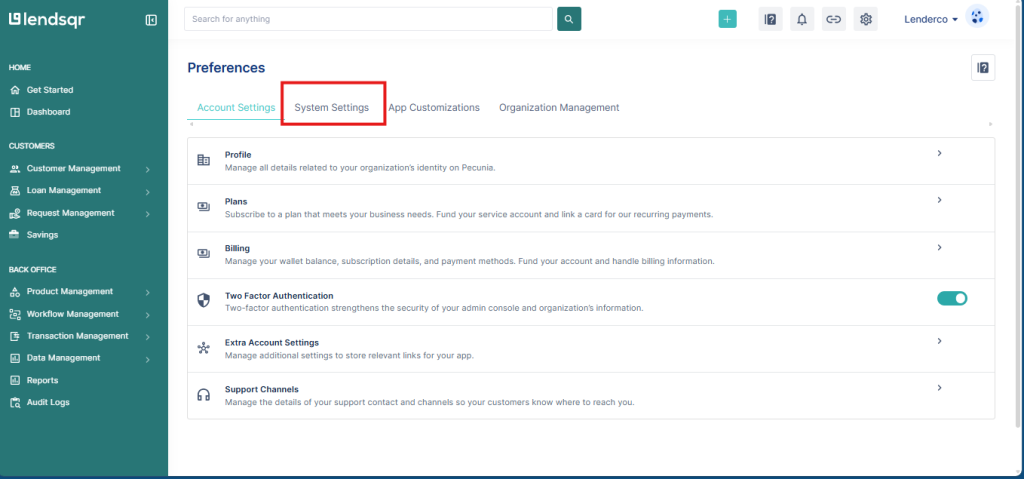

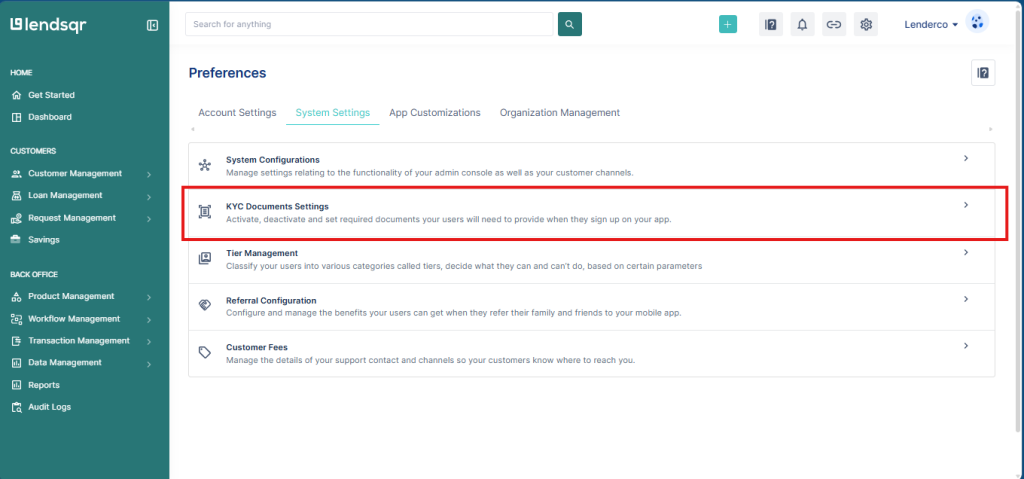

To manage organization documents on Lendsqr, below is a step-by-step guide:

- Navigate to “Preferences”

2. Navigate to the “KYC Document Setting” section, found by clicking on “System Settings”.

The documents settings page contains eight documents by default. These include:

- Identification Documents (International Passport, Drivers License, Voter’s Card, National Identity)

- Proof of Address(Electricity Bill, Waste Disposal Bill, Rent Receipt)

- Proof of Employment(Company ID card, Letter of Employment, Pay slip)

- Financial Documents(Bank statement)

- CAC 1

- CAC 2

- CAC 3

- Certificate of Incorporation

Lender admin users can configure the organization documents required from borrowers based on their internal policies. Properly managing document settings helps streamline verification and reduces friction in borrower onboarding.

Read further: The rise of retail finance in South Africa and what it means for modern lenders