The ability to create a new customer manually is a feature available to lenders through the Lendsqr admin console. It allows lenders to add a new customer profile directly into the system without requiring the customer to sign up through the mobile or web app. This is especially useful in situations where the customer is onboarded offline, or if the customer is having issues completing registration on their own. By entering essential details such as name, phone number, email, and BVN, the lender ensures the customer is properly registered in the system and can proceed with loan-related actions.

This process becomes particularly important when a lender needs to manually book a loan. A customer profile must already exist before any loan can be created on their behalf. For example, if a walk-in customer requests a loan but hasn’t used the app before, the admin can first create the customer’s profile manually, then proceed to manually book the loan with the appropriate terms. This ensures that all records are properly linked and the disbursement can be tracked and managed through the platform.

Manual customer creation also helps with edge cases, like offering loans to specific individuals who may not have access to digital onboarding. It gives lenders more flexibility and control, especially in low-tech environments or for high-touch customers who require personal support.

To create a new customer before booking a loan request, follow the steps below:

- Navigate to either the “Customers”, “Loans” or “Loan Requests” sub-tabs on the Lendsqr Admin console.

- Click the “Book New Loan” button on the page

- Enter the BVN of the customer you wish to create the loan for. The system validates the number and checks if the customer exists on your platform. If the customer does not, you will see the option to create a customer.

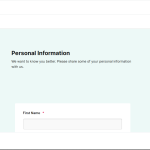

- Select the option to create a customer and enter all relevant customer details. These details are similar to what the customer would have submitted if they were onboarding via the app.

- After entering all relevant details (see data collected for customer creation below), click on the “Create customer” button. This will automatically create a customer and send them a welcome email

- You can then proceed to click the “Book loan” button to book a new loan for the customer you have created. See how to book loan manually for a customer to book a loan for a customer.

Data collected to create a new customer

To create a loan offline for a customer, you will need to ensure the following data are collected from the customer.

Most of these data will however be fetched from the records associated with their Bank Verification Number (BVN).

| Data | Description |

| Customer passport image | This should be a clear passport photograph of the customer similar to the selfie upload done during onboarding. The image size should be less than 20 MB. |

| Phone number | The customer’s phone number iin 080x xxx xxxx format. |

| The customer’s valid email address | |

| BVN | The customer’s BVN. Please note we also check if this BVN has been submitted on the platform as well. If this is the case, you would be required to |

| Phone number on BVN | The phone number assigned to the customer’s BVN in 080x xxx xxxx format. This would be used to validate their ownership of the BVN they provided |

| Date of Birth (DOB) | The customer’s DOB. This would be used to validate their ownership of the BVN they provided |

| Address | The customer’s street address |

| City | The city where the customer resides |

| State | The state where the customer resides |

| LGA | The local government where the customer resides |

| Account Number | The customer’s main bank account number |

| Bank | The customer’s bank |

| Documents | All documents you require the customer to provide for review before giving them a loan. Please note that it is important to provide all these documents beforehand as you would not be able to reupload them after creating the customer. |

Kindly watch the video below

Also read: You can now assign account managers to your customers