As a Lendsqr lender, you receive two accounts: a “Service Account” and a “Disbursement Account“, each with its own balance.

Service balance

This is the available amount in your Service Account. It is used to pay for Lendsqr services. Specifically, the system deducts charges or fees for services rendered from this balance.

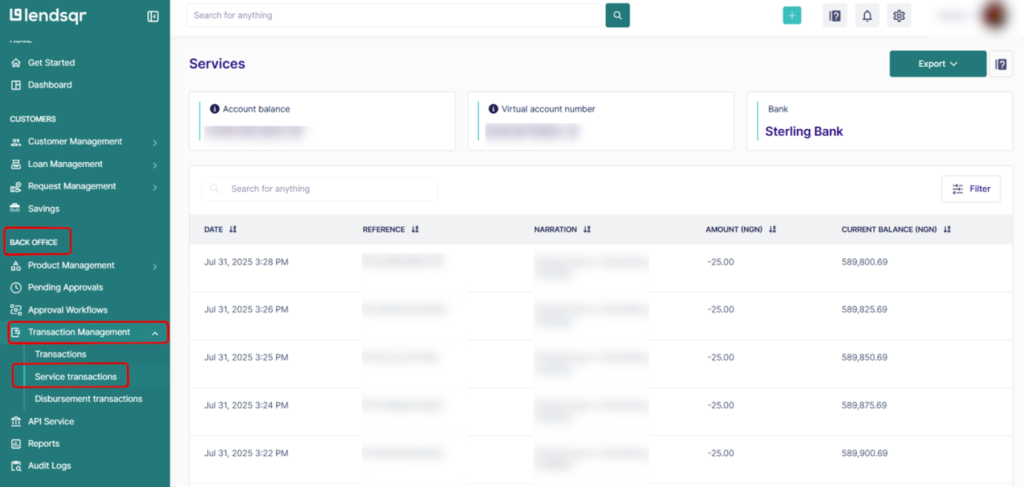

To view this:

1. Go to the “Service transactions” sub-tab under the “Transactions Management” tab in the “Back office” section.

2. On the service transactions page, you will see your service account and all details pertaining it.

Disbursement balance

This is the amount available for a lender to transfer funds to borrowers. To avoid issues, it should match or exceed the total funds in customers’ wallets. If it falls short, outward transfers may fail due to insufficient funds.

To avoid any issues with insufficient funds, it is recommended to maintain a disbursement balance that is sufficient to cover the expected outflow transfers for borrowers on the platform.

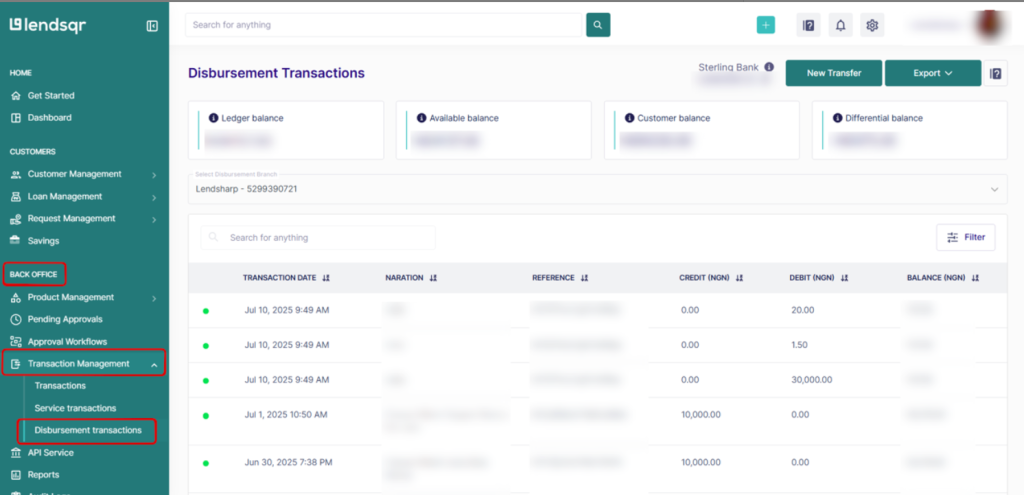

To view these details:

Go to the “Disbursement transactions” sub-tab under the “Transactions Management” tab in the “Back Office” section

You will see your disbursement account and all details pertaining it.

Also read: Why Lendsqr is Africa’s most affordable loan management software