Introduction

Bulk customer onboarding allows lenders to create multiple customer profiles at once by uploading a single file. Instead of entering each customer manually, you can prepare an xlsx file and upload it to the platform, saving time and ensuring consistent, error-free data entry.

For lenders managing hundreds or thousands of users, manual customer registration becomes slow, repetitive, and prone to mistakes. Lendsqr’s bulk onboarding feature solves this by enabling you to upload an entire list of customers in one action.

This feature is especially useful for lenders who:

- already operate offline and want to migrate existing customer records into the system

- onboard customers from partner organizations, agents, or field officers

- need to accelerate setup before launching new loan programs

- want to ensure their data is standardized and ready for automated credit scoring and disbursements

By using the Lendsqr bulk onboarding tool, you can streamline your onboarding workflow, reduce errors, and start lending faster.

Common use cases

Bulk onboarding is ideal for:

- Traditional microfinance institutions digitizing their customer records

- Agent networks that collect customer data in the field

- Cooperatives or thrift groups onboarding members at scale

- Fintech startups launching new products and needing all customers pre-registered

- Migration of data from an old system into Lendsqr

To bulk create customers, follow the steps below:

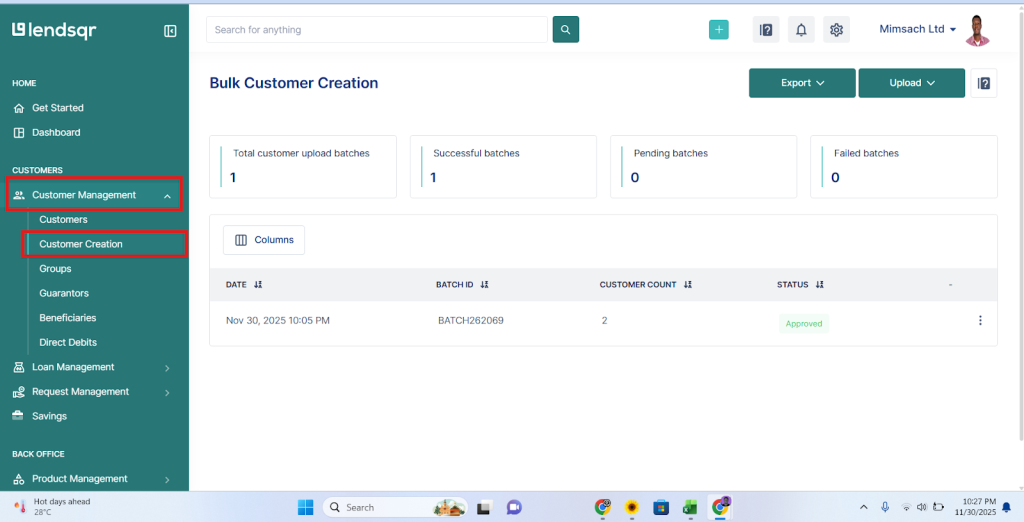

1. Navigate to the “Customers” section

- Go to the Customers tab under Customer Management.

- Click on Customer Creation.

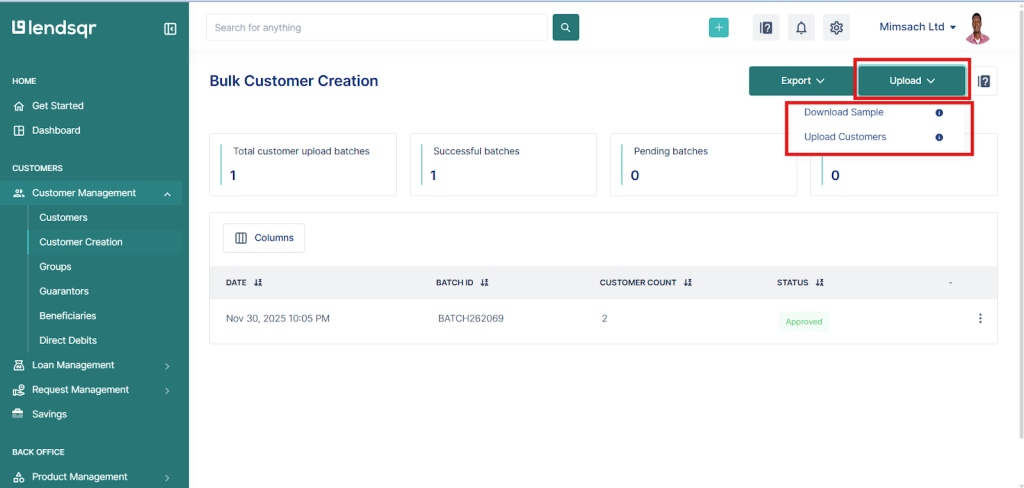

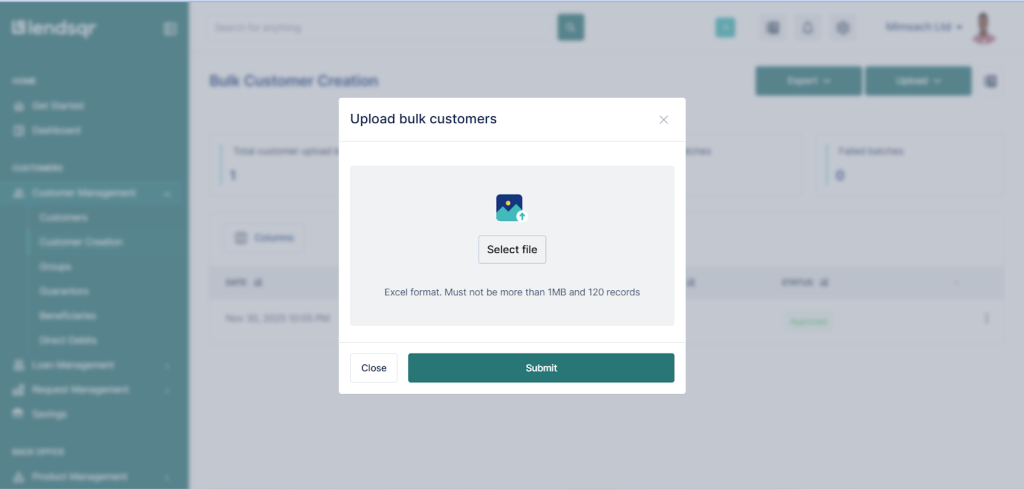

2. Click on the “Upload” button

Once on the Customer Creation page, click the Upload button.

A popup appears with two options:

- Download Sample – this gives you a sample Excel template.

- Upload Customers – used to upload the populated sheet.

3. Download and populate the customer template

- Click Download Sample to get the Excel sheet and proper format.

- Fill the sheet with your customer data.

- Important:

- Maximum number of records per upload: 120

- Maximum file size: 1MB

4. Upload your populated file

- After populating the sheet, click Upload Customers.

- Select the Excel file and proceed.

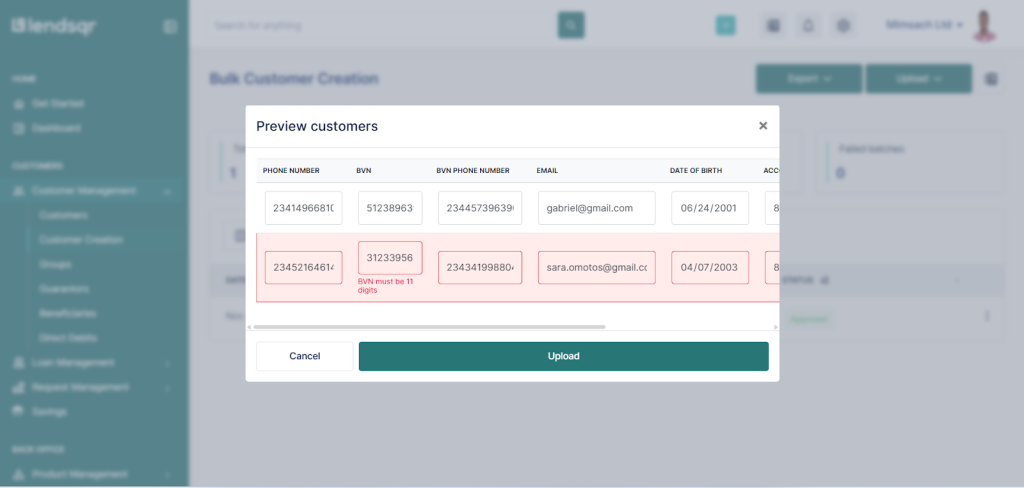

- Once uploaded successfully, a preview window will display all customer data from the file.

In this preview window, you can:

- Verify all data

- Edit incorrect entries

- Confirm before final submission.

If any row or column has an issue, it will be highlighted in red for easy identification.

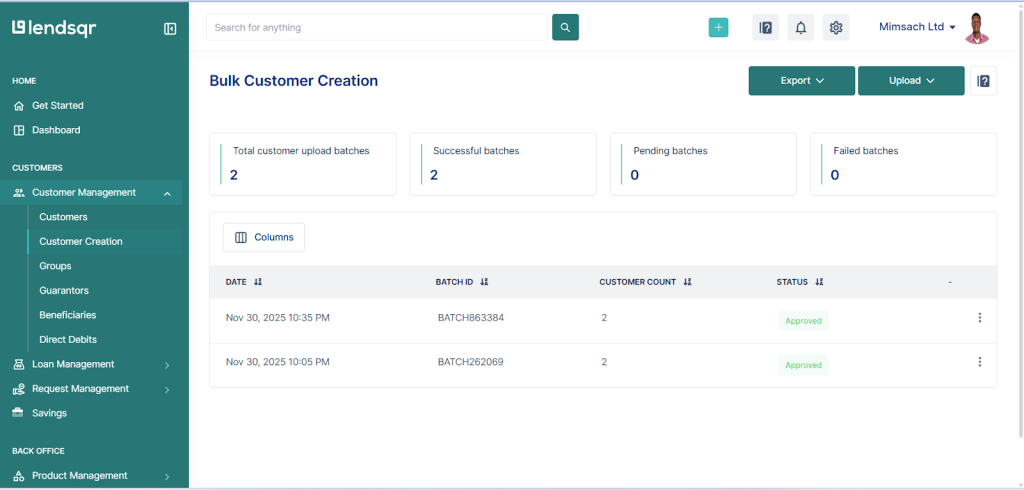

5. Submit your upload

- Once everything looks good, click Submit.

- The system returns:

- Upload date

- Batch ID

- Number of customers uploaded

- Status of the upload

If your organization already has an approval workflow set up, the upload will go through approval. If not, the upload is automatically approved.

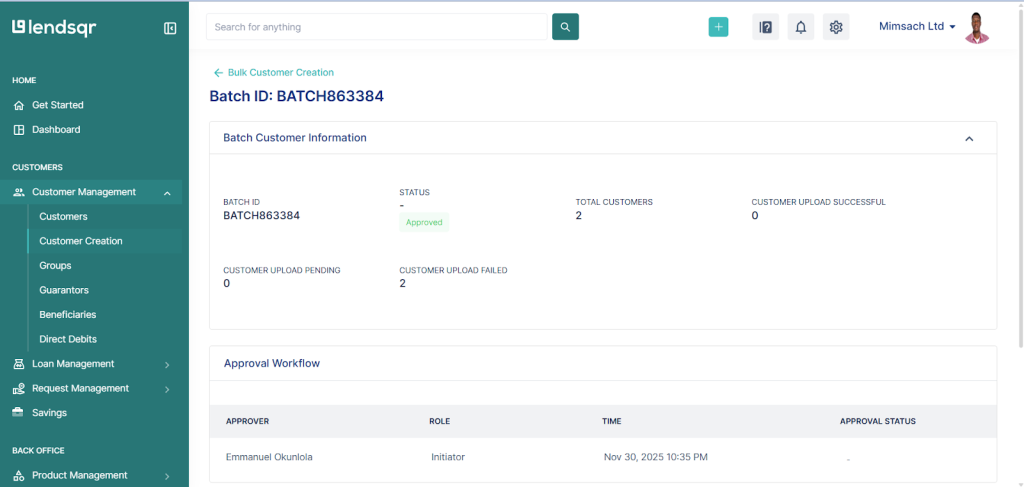

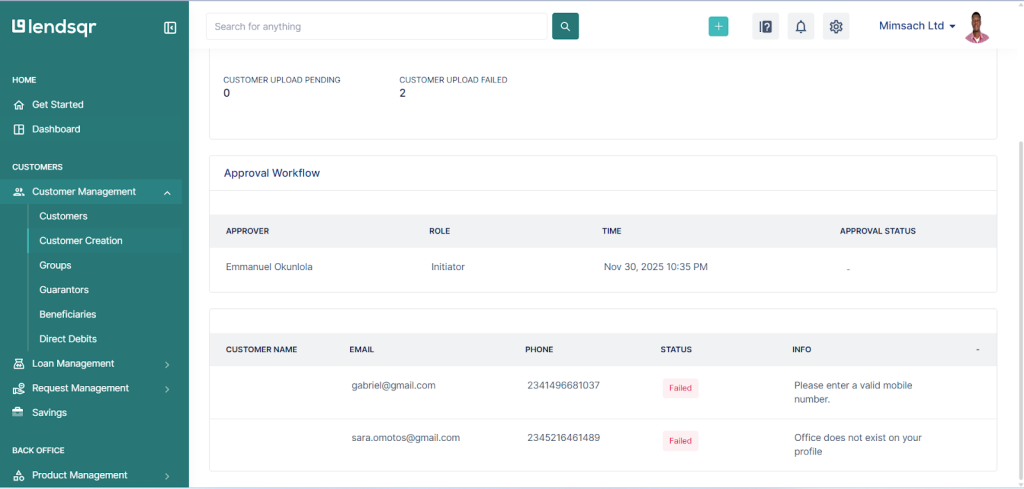

6. View details of your uploaded batch

To see more details:

- Click the three dots (⋮) on the upload record.

- You will see:

- Batch customer information

- Approval workflow

- Customer information with status for each record

Each customer shows whether they were successfully created or not, along with reasons for failure when applicable.

Template format (xlsx only)

Your upload file must be in xlsx format and must include the following fields:

| Field name | Description |

|---|---|

| Customer’s email address. | |

| phone_number | Customer’s phone number in international format (e.g., 234…). |

| date_of_birth | Customer’s date of birth in yyyy/mm/dd format. |

| bvn | Customer’s Bank Verification Number. |

| bvn_phone_number | Phone number registered with the customer’s BVN. |

| account_number | Customer’s bank account number. |

| bank_code | NIP bank code for the customer’s bank. |

| branch_id | Internal branch identifier (if applicable). |

Tips for a successful upload

- Ensure the file is saved strictly as .xlsx.

- Do not delete or rename required columns.

- Verify all BVNs and phone numbers are correct.

- Check that bank codes match valid NIP codes.

- Always use the sample template as a guide.

Read more – How to use the Bulk Disbursement feature on Lendsqr