The Expense and Transaction Request Approval Workflow helps lenders manage internal expenses and sensitive transaction disbursements securely and efficiently within Lendsqr. Every request is captured, reviewed, and authorized before funds are released, providing full operational control and accountability.

This workflow reduces risk, prevents unauthorized transactions, and ensures a complete, auditable record of all internal financial activities.

Why Lenders Need This Workflow

Financial institutions often have multiple staff members initiating expenses and disbursements across departments or branches. Without a structured approval process, transactions can be processed inconsistently or outside the platform, increasing the risk of errors or misuse.

With this workflow, every expense and transaction request:

- Is formally captured in Lendsqr

- Follows a structured approval process

- Is executed only after final authorization

- Leaves a full audit trail, including submission, approval, and decline events

This ensures internal funds are handled securely and consistently, giving lenders confidence in their operational controls and compliance.

How It Works

Lendsqr supports only the approval based mode of processing for expense transactions:

- Approval-Based Transactions: When an approval workflow is active, requests are held until reviewed and approved. Funds are only disbursed after final authorization

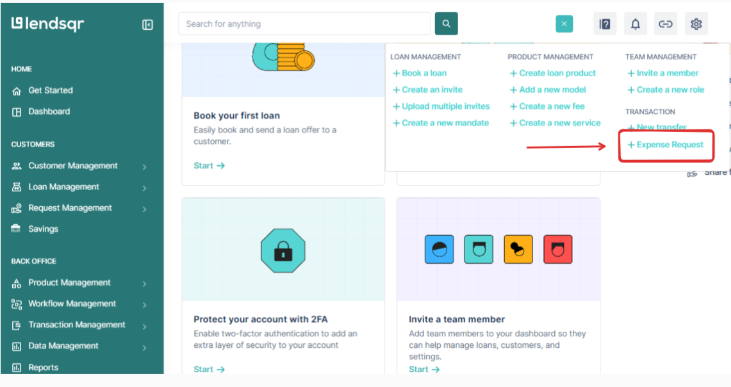

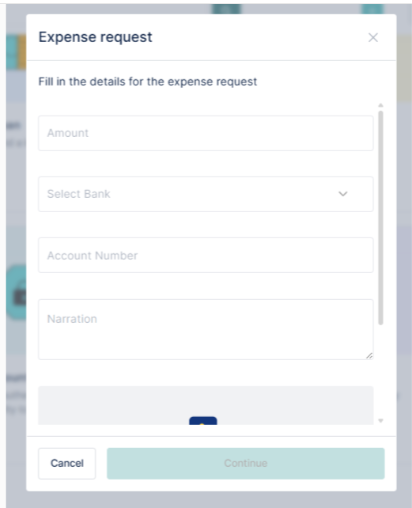

Submitting an Expense or Transaction Request

Authorized staff or admins can create an expense or transaction request by providing:

- Transaction details: amount, destination account, and narration

- Supporting documentation, such as receipts

For enhanced security, two conditions must be met before a request can be submitted:

- Two-Factor Authentication (2FA) must be enabled on the admin’s account

- An Expense Request Approval Workflow must be configured for the organization

Staff members confirm the request using an OTP. Upon submission, the request is logged as a submission event and routed to the designated approver(s).

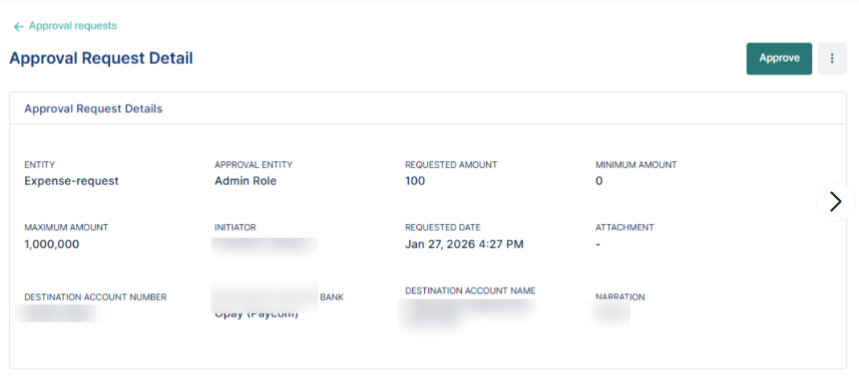

Review and Approval

Designated approvers review pending requests and take action:

- Approval: Approved requests are processed automatically, and the approval action is logged

- Decline: Declined requests are rejected, and the decline action, along with any comments, is logged

Approvers cannot modify the original request, ensuring the integrity of the workflow. Every action – submission, approval, or decline – is recorded to provide a clear and complete audit trail.

Visibility and Auditability

All events in the workflow are fully logged within Lendsqr. Lenders can see:

- Who submitted the request

- When it was submitted

- Approval or decline history

- Status changes and final outcome

This ensures full transparency, supports internal reviews, and makes regulatory or compliance audits straightforward.

Benefits at a Glance

- Stronger control: Only authorized requests are processed

- Enhanced security: Mandatory 2FA and pre-configured approval workflows prevent unauthorized or unsecured requests

- Operational efficiency: Automated processing of approved requests reduces manual effort

- Full transparency: Submission, approval, and decline events are all logged for a complete audit trail

Conclusion

The Expense and Transaction Request Approval Workflow provides lenders with a secure, auditable, and efficient way to manage internal expenses and transactions. It also reduces risk, improves accountability, and gives full visibility into all internal financial operations within an organization.

Read further: How to create an approval workflow

Also read: Reach more customers with the Lendsqr offline loan feature