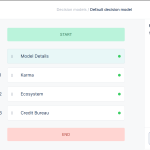

The Ecosystem is a module within the Lendsqr Oraculi decision engine. Oraculi decision model is made up of the settings for the model itself, which comprises of the decision modules and the offer settings. The other group of settings are individual settings for each of the decision modules.

Ecosystem is the module that checks the entire Lendsqr data ecosystem to see if a borrower meets certain criteria during decisioning. For example, it can be used to find out if a potential borrower is owing other Lendsqr lenders. This is similar to credit bureau data but on steroids.

The following describes the available data type and what each does.

| ID | Data Key | Name | Description | Sample Data |

|---|---|---|---|---|

| 1 | bvn | Bank Verification Number | This is an 11-digit number that uniquely identifies the borrower across the banking industry in Nigeria as well as an identifier the borrower has used to sign into applications in the Lendsqr’s ecosystem. | 22112345678 |

| 2 | first_name | First Name | This is the first name a borrower has used to sign in to different applications in Lendsqr’s ecosystem. | Mark |

| 3 | last_name | Last Name | This is the last name a borrower has used to sign in to different applications in Lendsqr’s ecosystem. | John-Sule |

| 4 | bvn_phone_number | Phone Number on BVN | This is the phone number attached to the BVN used to sign up on the applications across the Lendsqr ecosystem. | 7034138291 |

| 5 | date_of_birth | Date of Birth | This is the date of birth of a particular customer, entailing the day, month and year. This is validated against the customer BVN, done while onboarding to the Lendsqr ecosystem. If the date of birth does not match the one registered with the customer’s BVN, the customer is unable to proceed with the onboarding process. | 1/6/1978 |

| 6 | age | Age | This is the age of the borrower gotten from the date of birth that the borrower has put in in various applications in Lendsqr’s ecosystem. It is usually used to build the borrower’s credit score using the Scoring model. | 45 |

| 7 | unique_phone_numbers | Unique Phone Numbers | This is the number of unique phone numbers a user has across the ecosystem. A number higher than 2 may mean the user has a fraudulent intent. | 2 |

| 8 | phone_number | Phone Number | This is an 11-digit number that is assigned to a specific phone line or mobile phone. It is also an identifier with which a borrower uses to sign into applications in Lendsqr’s ecosystem. A number higher than 2 may mean the user has a fraudulent intent. | 7034138291 |

| 9 | unique_emails | Unique Emails | This is the number of unique emails a user has across the ecosystem. | 2 |

| 10 | This is the unique email address of a customer, used while signing up across the Lendsqr ecosystem. This also serves as an identifier for a customer across all Lendsqr lending platforms. | someone@example.com | ||

| 11 | gender | Gender | This is the gender of the borrower which is usually Male or Female. The gender is also used to build a credit score using the Scoring model. | Male |

| 12 | lenders | Lenders | This number indicates the number of lenders a user has signed up on within the Lendsqr ecosystem. | 1 |

| 13 | first_account | First Account Opened | This is the date and time a borrower first opened an account on any of the different applications within the Lendsqr ecosystem. | 2/28/20 19:08 |

| 14 | last_account | Last Account Opened | This is the date and time a borrower last opened an account on any of the different applications within the Lendsqr ecosystem. | 9/5/23 12:18 |

| 15 | failed_selfie_bvn_check | Failed Selfie BVN check | This is the number of failed Selfie BVN checks that a borrower has across the Lendsqr ecosystem. | 0 |

| 16 | lending_lenders | Lending Lenders | This is the number of lenders in Lendsqr’s ecosystem that are lending and are currently being used by the borrower. | 0 |

| 17 | loans | Loans | This is the number of loans a borrower has taken across different applications within the Lensqr ecosystem. A lender can decide the threshold that they want their borrowers to have. E.g., max loans: 10 | 0 |

| 18 | loan_amount | Loan Amount | This is the total amount of loans a borrower has previously taken across different applications within the Lendsqr’s ecosystem. | 0 |

| 19 | loan_amount_minimum | Loan Amount Minimum | This is the minimum loan amount a user has taken within the Lendsqr ecosystem. Lenders can use this history to decide on the kind of borrowers they want to give loans to. | 1,000 |

| 20 | loan_amount_maximum | Loan Amount Maximum | This refers to the maximum loan amount that a user has taken in the Lendsqr ecosystem. Lenders can use this history to decide on the kind of borrowers they want to give loans to. | 5,000,000 |

| 21 | loan_amount_average | Loan Amount Average | This is the average loan amount a borrower has previously taken in different applications in Lendsqr’s ecosystem. | 456,348.13 |

| 22 | settled_loans | Settled Loans | This is the number of loans that have been settled by a user borrower from different applications across the Lendsqr ecosystem. | 10 |

| 23 | settled_loan_amount | Settled Loan Amount | This is the total amount of loans previously settled by a borrower from different applications across the Lendsqr ecosystem. | 20,000 |

| 24 | settled_loan_amount_paid | Settled Loan Amount Paid | This is the total amount of settled loans previously paid by a borrower from different applications across the Lendsqr ecosystem. | 20,000 |

| 25 | running_loans | Running Loans | This refers to the total number of active loans a user has across the Lendsqr ecosystem. It is advised that loans should not be given to borrowers who have running loans on other loan applications. | 0 |

| 26 | running_loan_amount | Running Loan Amount | This refers to the total amount of active loans a user has across the Lendsqr ecosystem. It is advised that loans should not be given to borrowers who have running loans on other loan applications. | 0 |

| 27 | past_due_loans | Past Due Loans | This is the total number of past due loans a borrower has had in the Lendsqr ecosystem. A number higher than zero means the customer is defaulter and should not be given a loan. | 2 |

| 28 | past_due_loan_amount | Past Due Loan Amount | This is the total amount of past due loans a borrower has had in the Lendsqr ecosystem. An amount higher than zero means the customer is defaulter and should not be given a loan. | 0 |

| 29 | past_due_loan_amount_due | Past Due Loan Amount Due | This is the total loan amount due of a past due loan a user has had in the Lendsqr ecosystem. An amount higher than zero means the customer is defaulter and should not be given a loan. | 0 |

| 30 | penalty | Penalty | This refers to the fee that a borrower has to pay for failing to meet up with the due date for loan repayment. If a borrower has a history of penalty payments, it means they are possible defaulters and should not be given loans. | 0 |

| 31 | penalty_paid | Penalty Paid | This refers to the total amount of fees that a borrower has to pay for failing to meet up with the due date for loan repayment. If a borrower has a history of penalty payments, it means they are possible defaulters and should not be given loans. | 0 |

| 32 | penalty_loan_ratio | Penalty Loan Ratio | This is used to determine the allowable penalty incurred for a user to still access a loan. | 0.15 |

| 33 | delayed_paid_loans | Delayed Paid Loans | This is the total number of loans a borrower did not pay on time across different applications within the Lendsqr ecosystem. | 0 |

| 34 | delayed_paid_loan_amount | Delayed Paid Loans Amount | This is the total amount of loans a borrower did not pay on time across different applications within the Lendsqr ecosystem. | 0 |

| 35 | delayed_paid_loans_trials | Total number of trials on loans paid but not on time | 0 | |

| 36 | delayed_paid_loans_avg | Delayed Paid Loans Average | This is the average number of loans a borrower did not pay on time across different applications within the Lendsqr ecosystem. | 0 |

| 37 | delayed_paid_loans_trials_max | Delayed Paid Loans Trials Max | This is the allowable maximum total number of loans a borrower did not pay on time across different applications within the Lendsqr ecosystem. | 0 |

| 38 | delayed_paid_loans_trials_min | Delayed Paid Loans Trials Min | This is the allowable minimum total number of loans a borrower did not pay on time across different applications within the Lendsqr ecosystem. | 0 |

| 39 | first_loan_date | First Loan Date | This is the first date the borrower took a loan across different applications within the Lendsqr ecosystem. | 7/2/20 13:09 |

| 40 | last_loan_date | Last Loan Date | This is the last date the borrower took a loan across different applications within the Lendsqr ecosystem. | 9/13/23 19:18 |

| 41 | loan_requests | Loan Requests | This is the total number of loan requests a user has made within the Lendsqr ecosystem. | 0 |

| 42 | failed_loan_requests | Failed Loan Requests | This is the total number of unsuccessful loans requests across the Lendsqr ecosystem. | 0 |

| 43 | logins | Logins | This is the total number of logins a borrower has made on different lender applications within the Lendsqr ecosystem. | 280 |

| 44 | first_login | First login | This is the first login a user made on lender applications in the Lendsqr ecosystem. | 6/30/23 0:48 |

| 45 | last_login | Last Login | This is the last login a user made on lender applications in the Lendsqr ecosystem. | 9/15/23 12:23 |

| 46 | unique_login_ips | Unique Login IPs | The count of different IP addresses from which this user has logged into any of Lendsqr lenders’ apps. Very high numbers may indicate a fraudulent behavior. | 3 |

| 47 | unique_device_ids | Unique Device IDs | This is the total count of unique devices that a borrower has used to engage with different lender applications within the Lendsqr ecosystem. | 1 |

| 48 | distinct_mobile_os | Distinct Mobile OS | This is the count of unique mobile operating system a borrower has used to engage with different lender applications in Lendsqr’s ecosystem. | 1 |

| 49 | duplicated_devices | Duplicated Devices | This is the count to show how many times the user’s device has been used by another user within the ecosystem. | 1 |

| 50 | shared_device_users | Shared Devices | 0 | |

| 51 | credit_delinquency | Credit Deliquency | This is the number of delinquent credit facilities from Credit Bureau. This data is gotten from the activity of the lender across different lenders’ accounts. | 0 |

For more information on other decision modules, click here

Also read: How we built Oraculi to help lenders make informed decision