Among the various loan repayment methods available to match borrower profiles, direct debit stands out for its reliability and simplicity.

This payment method provides lenders with a convenient way to automatically retrieve funds from a customer’s account exactly when their loan repayment is due, ensuring timely collections and reducing the risk of defaults.

To activate this feature on your loan product, follow these few steps:

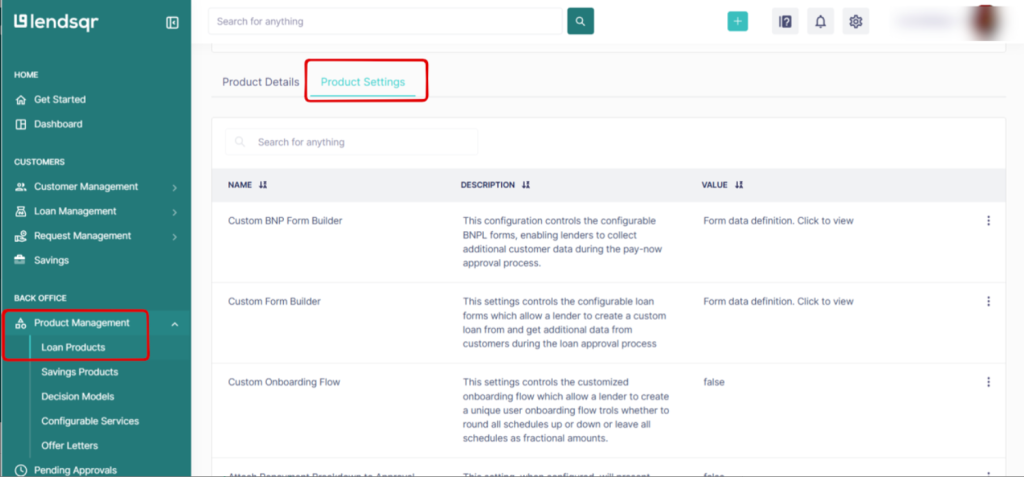

1. Log in to the Lendsqr admin console, click on “Product Management”, then “Loan Products”, select the specific loan and go to the “Product Settings” section.

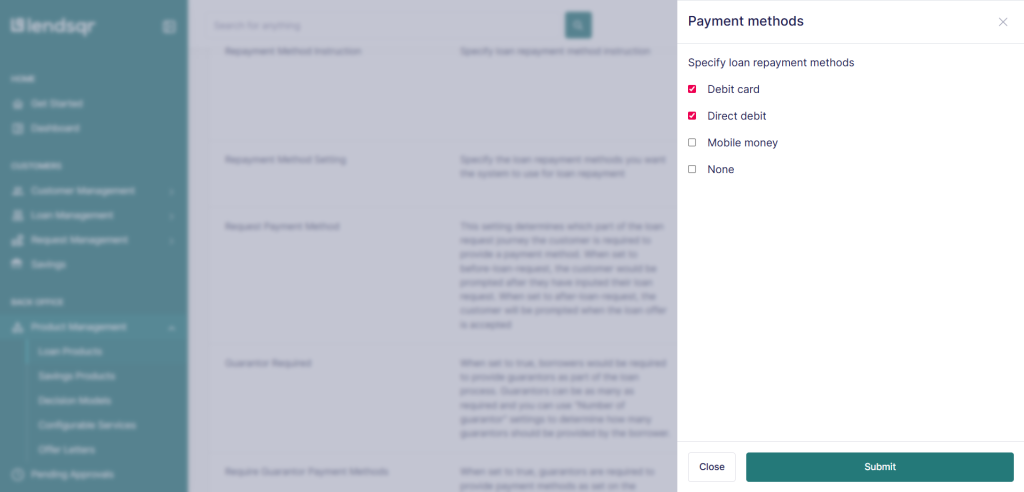

2. Under the “Product Settings” section, scroll to “Repayment Methods”, click on edit then choose “Direct Debit“, please note that you can choose both direct debit and debit card.

3. As a lender, once you set direct debit as the repayment method, borrowers must then activate a mandate electronically. They do this by making a transfer from their linked account to complete the loan application process. You can read How to activate a mandate

How to set up a mandate for a user

As a Lender on Lendsqr, you can also create a mandate to collect funds that were booked outside the Lendsqr ecosystem. This can be done by creating a direct debit mandate on the admin console for the customer’s account.

Also read: Introducing third-party disbursement: A game-changing feature for lenders