Lendsqr has its own core banking application, but microfinance banks and other lenders can also integrate theirs seamlessly with Lendsqr.

A Core Banking Application (CBA) is a central software that banks and lenders use to manage their daily operations, like customer accounts, loans, transactions, deposits, withdrawals, and more, in real time.

In essence, it’s the backbone of a bank’s operations, ensuring that all financial activities are processed efficiently and accurately.

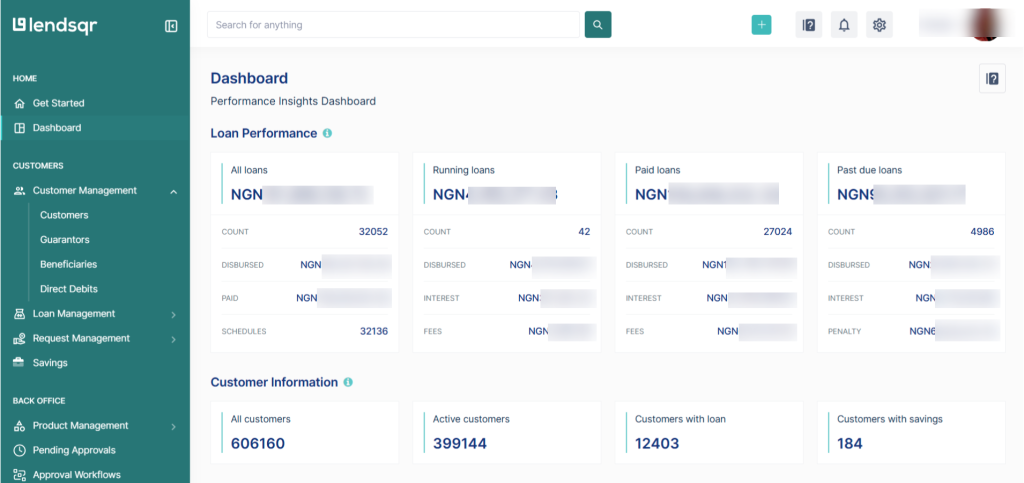

Lendsqr’s CBA is a software system designed specifically to support digital lending at scale. It enables lenders to manage loans, customer accounts, repayments, and disbursements efficiently. Our platform is built to be flexible and robust, allowing both small and large lenders to automate their lending operations while ensuring compliance, security, and reliability.

For further information, please don’t hesitate to contact us at sales@lendsqr.com

Also read: 7 strategies to avoid SME loan defaults as a Nigerian Lender