Introduction

A borrower is an individual or a business that receives money from a lender with the agreement to repay it under specific terms. These terms often include the loan amount, interest rate, repayment schedule, and any applicable fees.

For example, a small business may take a loan from a digital lender to finance equipment. The business becomes a borrower once it accepts the loan offer, agrees to the terms, and receives the funds. Repayment then follows the agreed timeline until the debt is cleared.

Understanding who a borrower is helps lenders assess risk, assign loan products correctly, and maintain responsible lending practices.

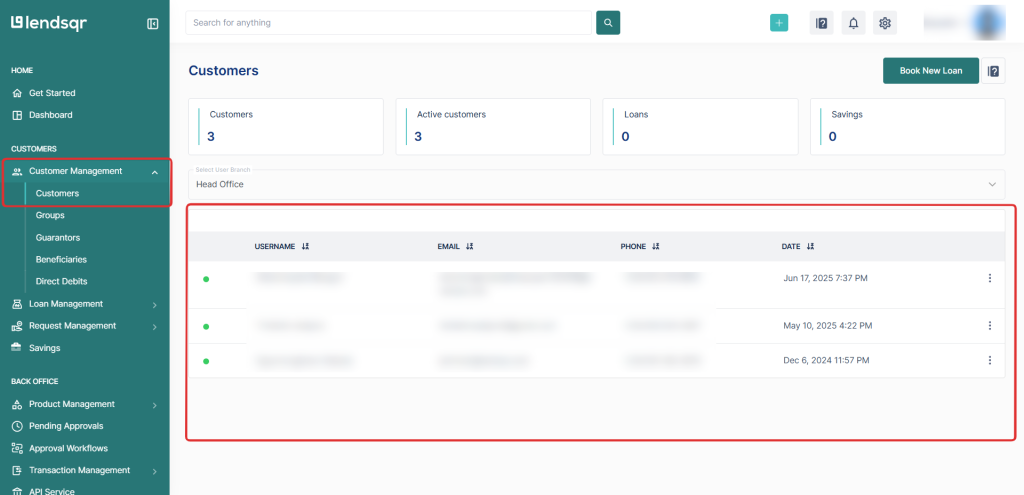

You can find your borrowers on the Customers section under Customer Management

Read further: How to spot and block fraudulent borrowers