The Whitelist feature is a powerful customer pre-qualification tool within the Lendsqr Admin Console that enables administrators to create targeted loan products for specific users or user groups.

Read more here

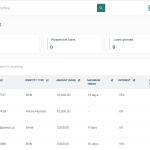

How to access whitelist on the Lendsqr admin console

Navigate to Customer Management → Customers in the side navigation menu of your Lendsqr Admin Console to access the Whitelist functionality.

Key features and benefits

Pre-qualify customers

- Pre-approve eligible customers before they apply for loans

- Streamline the loan approval process for qualified borrowers

- Reduce manual review time for trusted customers

Flexible customer identification

The Whitelist feature supports multiple customer identification methods:

Email address – Match customers via email verification

BVN (Bank Verification Number) – Verify customers using their banking credentials

Phone number – Identify customers through mobile contact information

How whitelist works on the Lendsqr admin console

- Admin Setup: Administrators add customers to the whitelist using BVN, phone number, or email

- Product Assignment: Specific loan products are created and assigned to whitelisted customers

- Customer Application: When whitelisted customers apply for loans

- Automatic Qualification: Customers gain instant access to whitelist loan products when applying for amounts equal to or less than their approved whitelist limit

Benefits for lenders

- Improved Customer Experience: Faster loan processing for pre-qualified customers

- Risk Management: Better control over loan approvals and customer segmentation

- Operational Efficiency: Reduced manual processing for trusted borrowers

- Customer Retention: Enhanced service for valued customers

Learn more about Lendsqr here