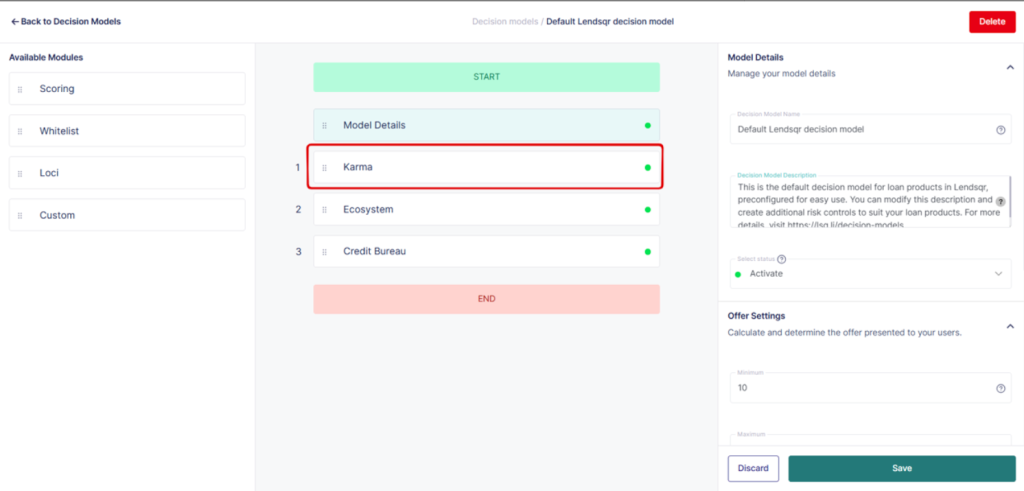

Karma is a blacklist engine that stores information on parties who defaulted on loans or committed fraud on Lendsqr-powered platforms.

These systems help lenders assess risk before approving loans or extending credit facilities. For example, if a borrower has a record of missed payments or legal disputes over unpaid debts, this information is flagged in the database. Lenders can then decide whether to approve, reject, or request additional guarantees for the loan application.

Karma is open to other financial parties outside Lendsqr that are also interested in this service.

Also read: How Lendsqr is using AI to transform its processes