You can update a loan status to “Terminated” when repayment has been made, but the loan is no longer valid or fully active.

For example, if the loan is past its due date and the user never withdrew the funds, but the system still collected repayment from their wallet or card, you should mark the loan as Terminated.

If the system collects more than required, including interest, you must reverse the extra amount.

You can also use this feature when a user has repaid almost the entire loan but has only a very small balance left. In this case, an admin may choose to close the loan by updating its status to Terminated.

How to update a loan status:

- Locate the loan using the steps in the previous section.

- Click the three dots in the top-right corner of the loan profile.

- Select “Terminate Loan” from the dropdown.

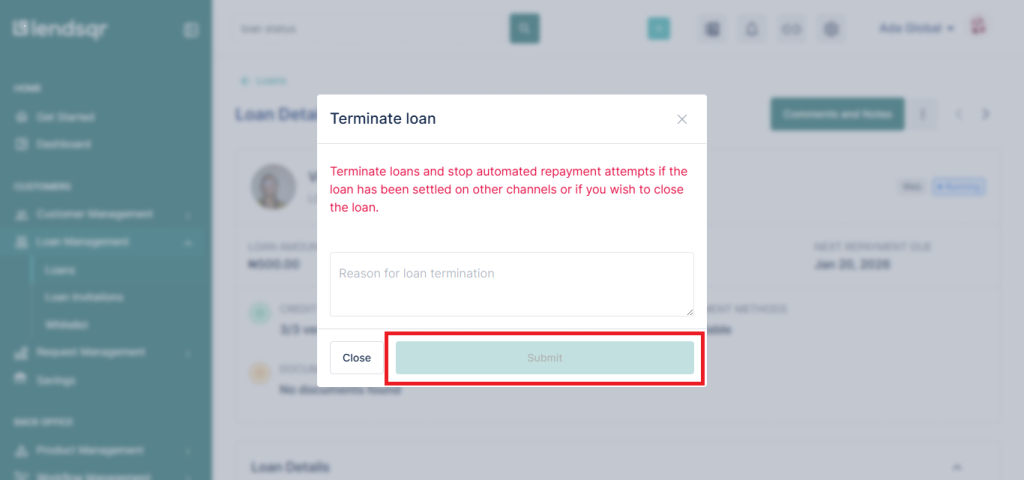

- A modal will appear, fill in the necessary details.

- Choose “Submit” and confirm.

Note: You can only update loans to “Terminated” or “Settled”. This is especially useful for writing off loans with no withdrawal or minor remaining balances.

Read further: We’re giving our lending tech away for free to non-profits and DFIs