The offer setting is used to determine the loan amount and other offer information that will be presented to an eligible user. The offer settings make use of rules in JSON, and this allows for more complex configurations.

Read more: Importance of credit scoring for loan decisions

It makes the offer calculations to be intuitive and robust enough to factor in different variables. In the default offer setting, the main variable used is the requested_amount.

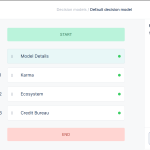

Below is the default format for an offer setting;

The offer settings is almost infinitely configurable which allows a lender to vary the loan amount, tenor, and fees offered to a customer. For example, with offer settings a lender can do the following:

- Based on the time of the day, configure a loan to be disbursed instantly or sent to the loan offer for a review

- Use information about location and salary to vary the amount offered

- Progressively upgrade the maximum amount or tenor given as an offer based on previous loan performances

Note:

Offer settings can also make use of the income variable generated from the income module check. To make use of this configuration, you would need to configure the income module in your decision settings.

Kindly contact support staff for more information.

Further Information: Adding a custom scoring module to your decision model