Lending isn’t just about approving or declining applications — it’s about ensuring loans go to customers with the right financial discipline. That’s where the Loan Savings Multiplier comes in.

With this setting, you can configure your loan products to factor in a customer’s savings balance before approving their application. It creates a smart link between how much a customer saves and how much they can borrow.

What Is the Loan Savings Multiplier?

The Loan Savings Multiplier is a configuration that applies a multiplier to the customer’s total savings balance.

- If the product of (Multiplier × Total Savings) is greater than or equal to the loan amount requested, the loan is approved.

- If not, the application is declined, and the customer receives a message explaining why.

👉 In short: the more your customers save, the more they can borrow.

Why It Matters

- Drives a savings culture → Customers are motivated to build savings if they want larger loan limits.

- Manages lending risk → Loans are tied to actual customer liquidity, reducing default chances.

- Creates fairness → Loan eligibility is linked to each customer’s financial behavior within the platform.

Real-World Example

Let’s say you configure a loan product with a Savings Multiplier of 2.

- Customer’s total savings = ₦20,000

- Loan requested = ₦30,000

- Calculation → 2 × 20,000 = ₦40,000

✅ Since ₦40,000 ≥ ₦30,000, the loan application proceeds.

But if the customer had only ₦10,000 in savings:

- 2 × 10,000 = ₦20,000, which is less than ₦30,000.

❌ The system would decline the application and notify them to increase their savings.

How to set it up in the Admin Console

1. Login to the Admin Console

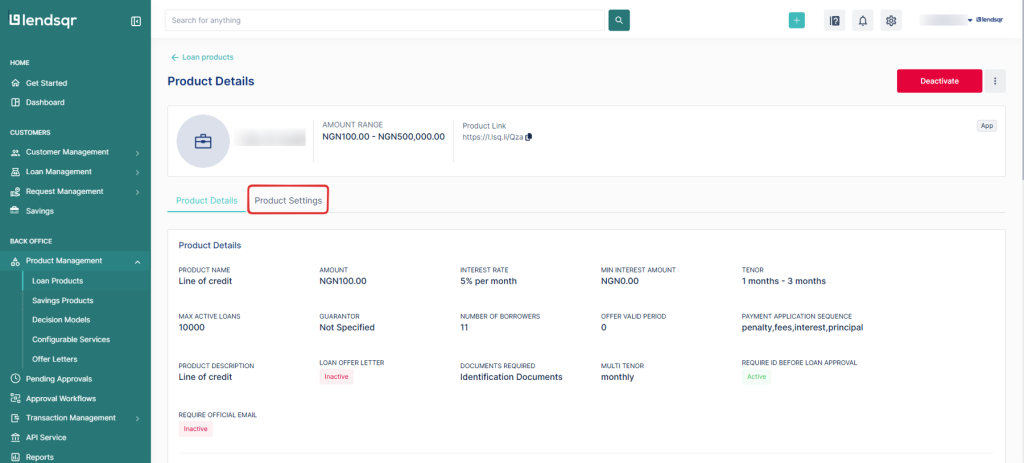

2. Click on “Loan Products” under “Product Management“

3. Create a loan product or open an existing one

4. Click on the “Product Settings” tab on the “Product Details” page.

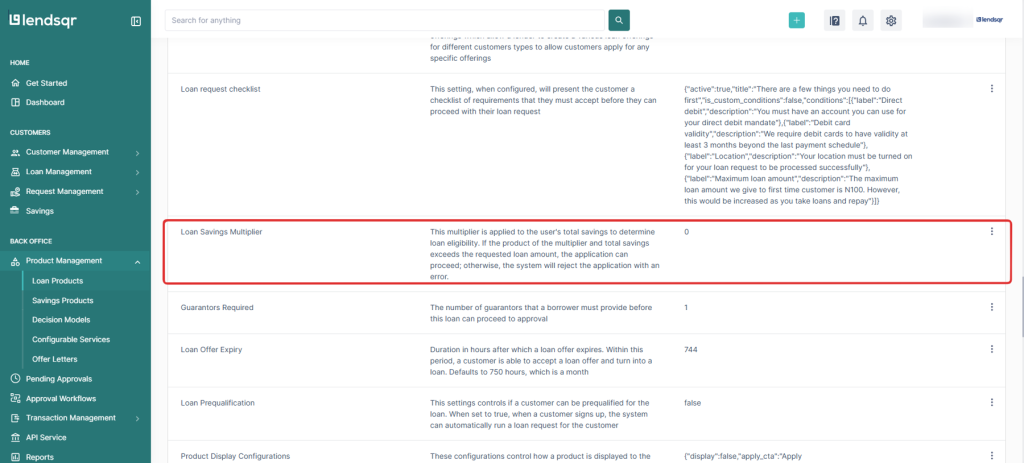

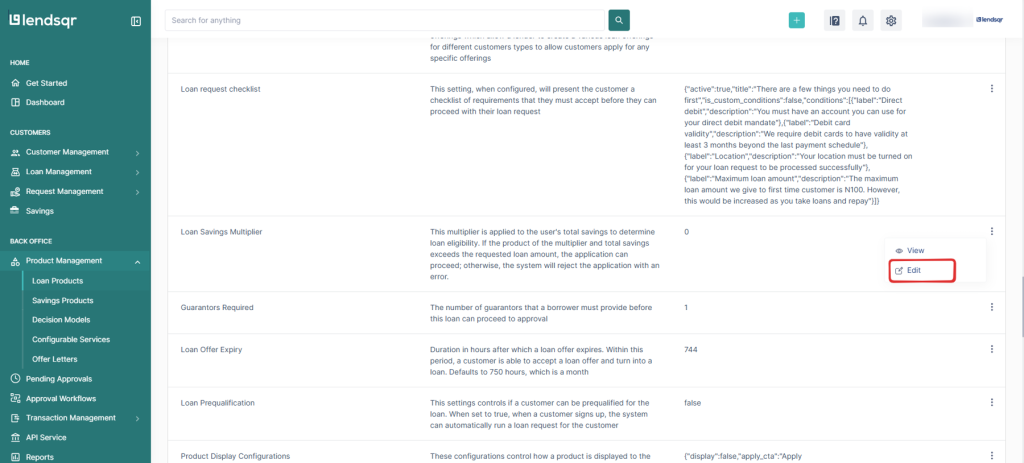

5. Locate the “Loan Savings Multiplier” setting. Click on the “three dot” icon and select “Edit” beside this attribute.

6. Enter the multiplier (e.g., 1, 2, 3, etc.)., and click on the “Submit” button to apply the changes to the loan product.

Also read: How Lendsqr is using AI to transform its processes