Product fees are charges that lenders apply to borrowers for various services and processes associated with lending. These fees ensure that your lending business can cover its operational costs and manage risks effectively. To support this, Lendsqr allows you to create and customize different types of fees directly from the admin console, tailored to the services you offer your borrowers.

Types of Fees You Can Create from the Admin Console

Lendsqr supports a range of fee types, each serving a specific purpose:

- Equity Contribution: While not a traditional fee, this is an amount a borrower must have available in their wallet before the loan is disbursed. It ensures the borrower has a vested interest in the loan. (Learn more about this here.)

- Loan Extension Fee: This is applied when a borrower requests an extension on their loan repayment period. It helps cover additional administrative work and compensates for the potential risk of extending the term.

- Management or Subscription Fee: Charged periodically, much like a subscription, for providing continuous access to lending services.

- Penal Fee: This is imposed for late repayments or violations of loan terms, serving both as a deterrent and compensation for delayed cash flow.

- Regular Fee: A one-time standard fee that covers basic loan maintenance or processing.

Fee Type Calculation

When setting up these fees, it’s important to define how they should be calculated. Lendsqr supports three methods:

- Fixed: A set amount charged regardless of loan amount.

- Percentage: A fee calculated based on a percentage of the loan principal or total value.

- Hybrid: A combination of both fixed and percentage-based amounts.

Here is a step by step guide on how you can create a fee on the admin console:

- Login to the admin console

- Navigate to “Loan Products” under “Product Management”.

- Once logged in, locate the side navigation and click on “Product Management.”

- In the dropdown menu, select “Loan Products.”

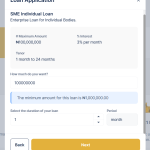

3. Create or Update a Loan Product

- To create a new loan product, click on the “New Loan Product” button.

- To update an existing product, find the product in the list and click on the “Edit” button next to it.

4. Access the Fees Section

- Scroll down to the “Fees” section of the loan product form.

- Click on the “Create a new Fee” button to open a modal window.

5. Fill in the fee details

- In the modal window, choose a fee by clicking on the checkbox beside the fee from the list of fee types.

- Fill in the required details for that type of fee, including the name, amount, grace period, charge type or fee calculation type (e.g., percentage or fixed amount), etc.

6. Submit and Close the Modal

- After entering the details, click on the “Create Fee” button to save the fee.

- Close the modal window to return to the loan product form.

7. Activate the fee

- In the Fees section, locate the newly created fee.

- Toggle the switch to activate the fee for this loan product.

8. Save Changes

- Scroll to the bottom of the loan product form.

- Click on the “Save” button to create or update the loan product with the fee.