Introduction

In some cases, lenders use customers’ savings as collateral to secure loan repayment. To prevent customers from withdrawing funds that may be used as collateral before loan repayment, lenders can configure approval workflows for savings products.

This ensures that any withdrawal request from a savings product follows a structured approval process, requiring authorization before funds are released. At Lendsqr, lenders can easily create and assign approval workflows to savings products, ensuring better control and repayment assurance.

Steps to Add an Approval Workflow to a Savings Product

1. Log in to the Admin Console

Open your web browser and log into the Lendsqr Admin Console with your credentials.

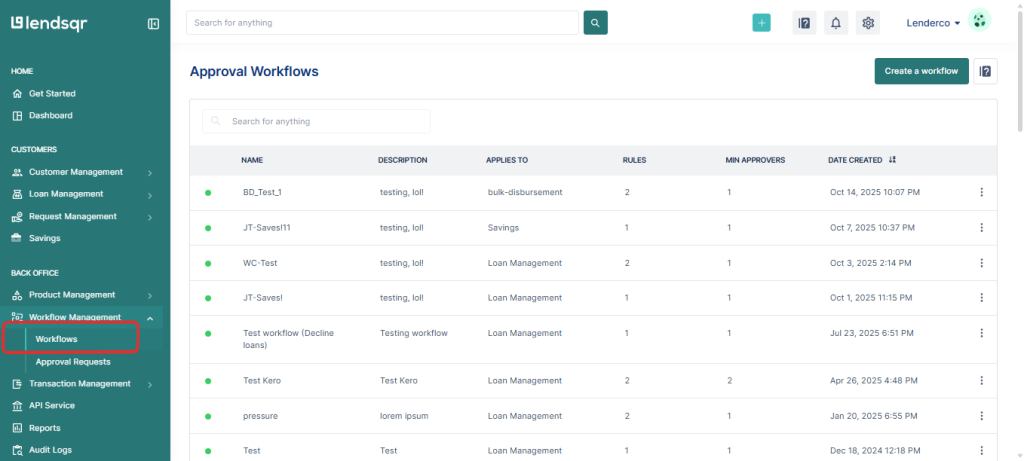

2. Locate the “Workflow Management” Section

Scroll through the settings page until you find the Workflow management section and click on ‘Workflows’

3. Create or Select an Approval Workflow

You can either:

- Select an existing workflow from the dropdown if one already exists, or

- Click Create Approval Workflow to set up a new workflow.

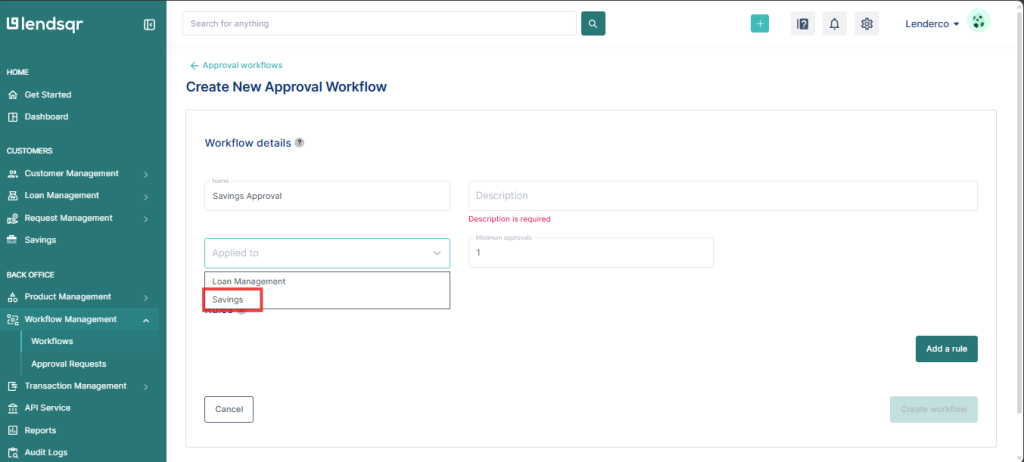

When creating a new workflow:

- Define the approval stages

- Set up the rules and responsibilities for each approver.

4. Attach the Workflow to a Savings Product

Once the workflow has been created or selected, link it to the specific savings product.

This ensures that any withdrawal requests from that product will follow the approval sequence you’ve configured.

5. Navigate to “Savings Products” under Product Management

From the main dashboard, go to Product Management → Savings Products.

6. Create a New Savings Product or Open an Existing One

- If you’re creating a new savings product, click on the Create button.

- To add an approval workflow to an existing product, click on the savings product from the list.

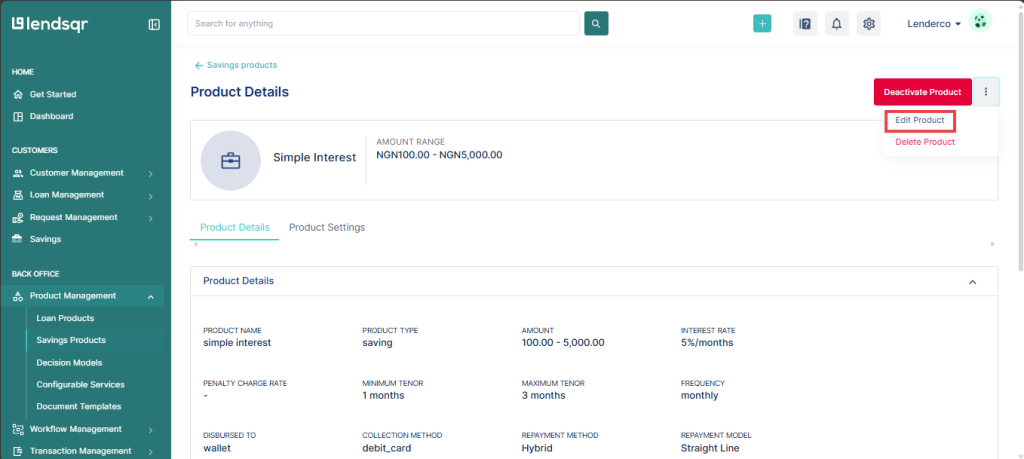

7. Edit the Savings Product

Click on the three-dot menu (…) at the top right corner and select Edit product.

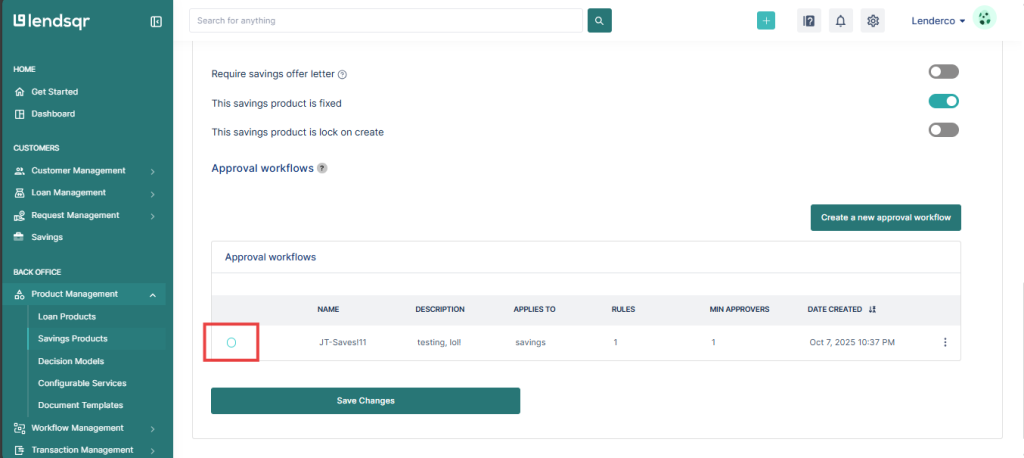

8. Save Changes

Scroll to the bottom of the page and click Save Changes.

Once saved, the approval workflow will automatically apply whenever a withdrawal is initiated from that savings product.

Outcome

When a customer requests a withdrawal from the savings product:

- The request will be routed through the configured approval stages.

- The withdrawal will remain pending until all assigned approvers have granted final approval.

- Only after full approval will the customer be able to access their funds.

This process prevents premature withdrawals and safeguards lenders’ interests when savings are used as collateral for loans.