At Lendsqr, penalty charges can be calculated using any of these three methods: fixed, percentage, or a hybrid method.

The hybrid method combines a fixed fee with a percentage of the outstanding amount. Typically, this approach includes both a minimum charge and a maximum cap. For instance, a lender might set a penalty at 1% of the overdue amount, with a minimum of ₦50 and a cap of ₦2,500. Additionally, lenders can configure the type of fee based on their specific preferences.

Before applying any penalty, lenders typically provide borrowers with a grace period, a set number of days after the due date during which no penalty is charged. Moreover, this grace period is configurable and can even be set to zero, depending on the lender’s preferences.

To configure penalties, including grace periods and the fee structure, lenders could make these adjustments within the “Loan Product” settings, specifically in the “Fees” section of the admin console.

Steps

To create a penalty fee for an existing loan product, follow the steps below:

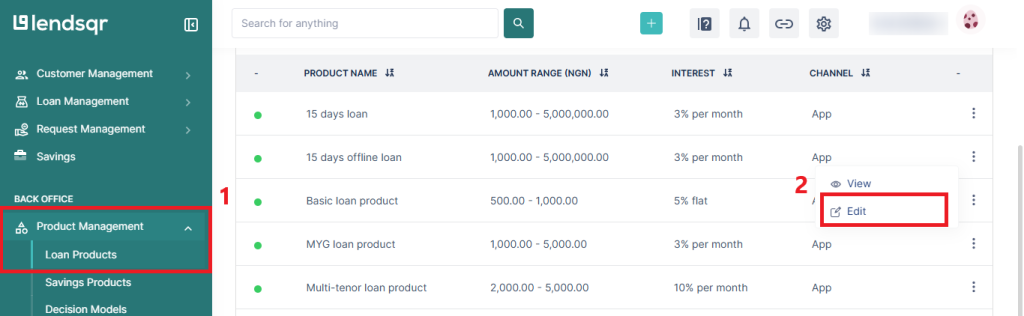

1. From your dashboard, navigate to the left-hand menu. Under the “Back Office” section, click on “Product Management”, then select “Loan Products”. Locate the loan product you want to configure. On the far right of that product row, click the three vertical dots to access the actions menu.

2. Click on “Edit” from the menu options.

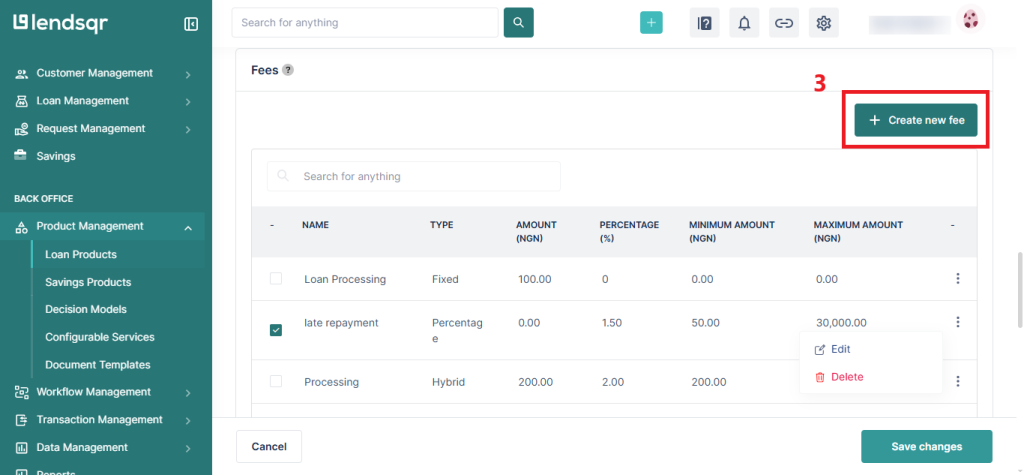

3. Within the loan product settings, scroll to the “Fees” section. This is where you can define penalty charges tied to the loan. Click on “Create new fee”.

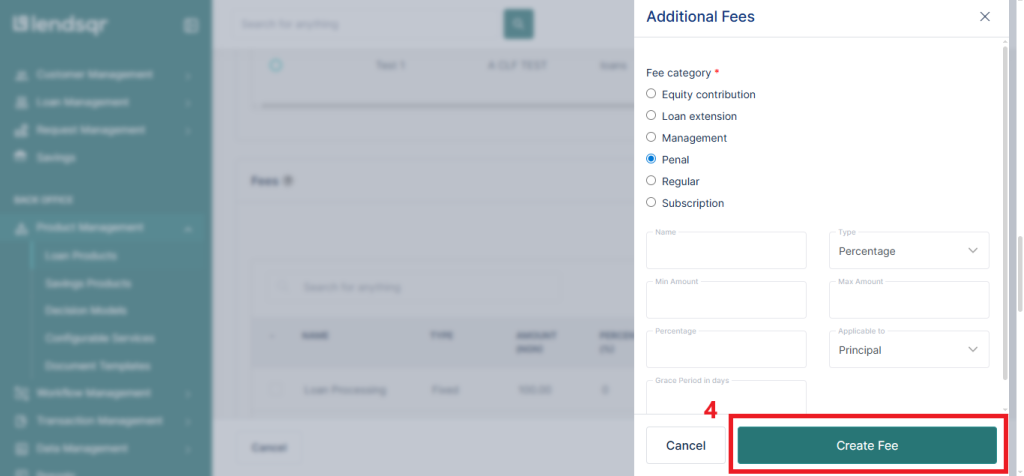

4. Select “Penal” and fill in the penalty fee details by providing the information in the required fields. Once all fields are filled in, click the “Create Fee” button at the bottom right to save changes.

Having followed the steps above, the penalty charge will automatically update on the loan product. Also note that penalty fees could be configured while creating a new loan product as well.