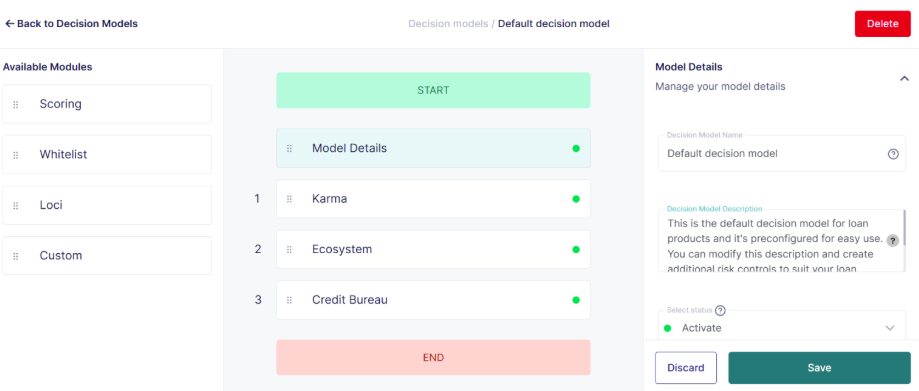

Every new Lendsqr account comes with a sample of a new decision model, designed to support most basic retail lending needs.

However, to meet a lender’s peculiar requirement, a new model can be created. On the Lendsqr platform, decision models help streamline and standardize lending by making it quicker and more intelligent. You can create custom models tailored to your unique risk tolerance and lending goals. For instance, you could set a rule like: “Approve loans below $200 for applicants with no outstanding loans and a monthly income above $500.” This ensures consistent evaluations, minimizes fraud, boosts efficiency, and empowers you to scale your lending with confidence.

There are two ways on how to create a new model:

- Clone the existing model and then fine-tune it

- Create a new one entirely from scratch

As Lendsqr decision models are very powerful with over a 100 parameters, the most efficient approach would be to clone the existing model and make changes.

Click here to learn more about decision model settings.

Also read: How we built Oraculi to help lenders make informed decision