What is a decision model

A decision model is the set of rules and checks lenders use to automatically determine if a borrower qualifies for a loan and what kind of offer they should get. These models evaluate factors like credit score, income, employment history, or past loan performance, and then generate a loan offer based on predefined conditions.

Duplicating an existing model

Duplicating a decision model is useful when you want to create a new model that’s similar to an existing one without starting from scratch. For example, a lender might already have a decision model for salaried employees and now wants to create a slightly different version for self-employed borrowers. Instead of building a new model from the ground up, they can simply duplicate the existing one and adjust just a few rules, like changing the income verification method or offer settings. This saves time, ensures consistency, and helps lenders test or roll out new lending strategies faster and more efficiently.

To create a new model from an existing one, follow the steps below:

- Navigate to the Decision Model tab under the Product Management grouping.

- On the existing model of your choice, click on the options button (represented by the 3-dots) and select “Duplicate”.

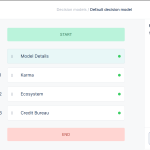

- The decision model page will be displayed to you. Enter the name and description as described in the section above and save.

Duplicating decision models on the Lendsqr admin console is a quick and efficient way to adapt your lending strategy without rebuilding everything from scratch. Whether you’re targeting a new borrower segment or testing slight variations in your rules, duplication helps you save time, maintain consistency, and scale faster, while keeping full control over how your loan decisions are made.

Want to know more about decision models? Click here

Also read: How we built Oraculi to help lenders make informed decision