Processing payments to multiple customers one by one can be time-consuming and prone to errors. With Bulk Disbursement on the Lendsqr Dashboard, you can automate and send payouts to several customers at once whether for loans, savings withdrawals, or general payments. This guide walks you through how the feature works, how to prepare your upload file, and what each field means.

What Is Bulk Disbursement?

The Bulk Disbursement feature lets lenders or organizations handle multiple customer payouts in a single action. Instead of processing each transaction manually, you can upload a CSV file that includes all the payment details, and the system automatically processes them.

It’s ideal for:

- Loan disbursements to multiple borrowers

- Savings or investment payouts

- Vendor or salary payments

- Any type of mass financial transaction

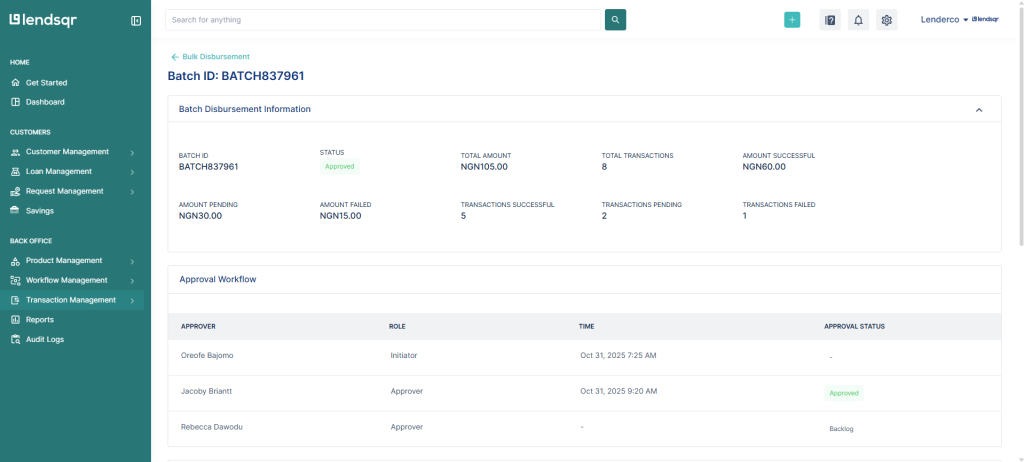

Once uploaded, the batch goes through your defined approval workflow (if applicable), and you can track the progress from pending to approved, or rejected directly within your dashboard.

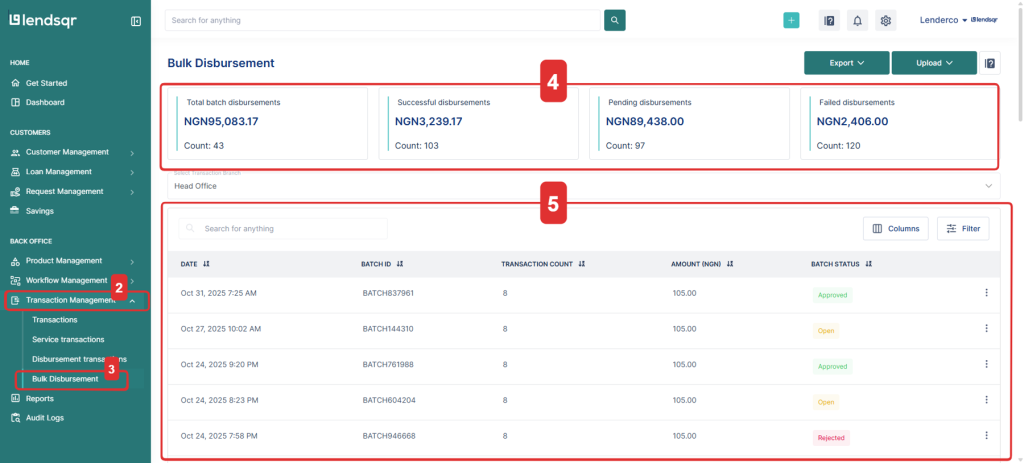

How to access Bulk Disbursement

- Log in to your Lendsqr dashboard.

- Navigate to Transaction Management on the left sidebar.

- Select Bulk Disbursement.

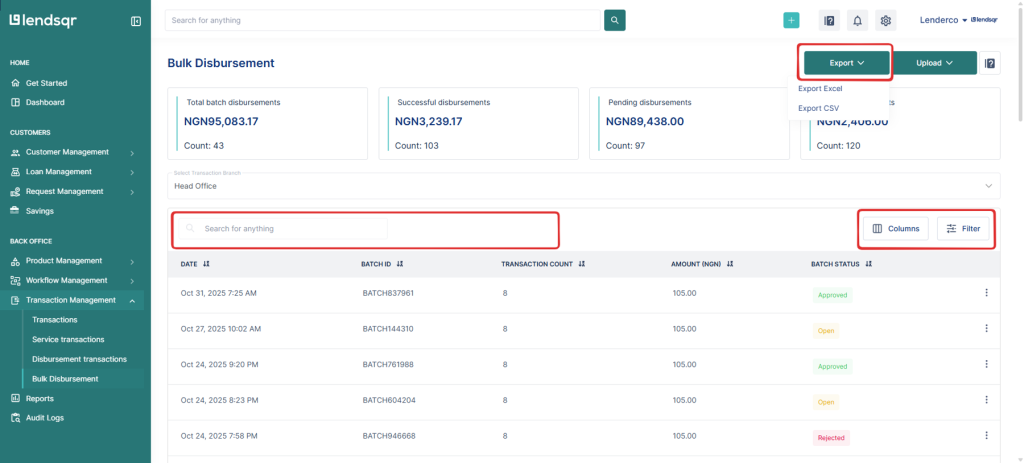

- You’ll see a summary section showing:

- Total batch disbursements

- Successful disbursements

- Pending disbursements

- Failed disbursements

- Below the summary, you’ll find a list of all your uploaded batches along with their batch IDs, transaction counts, amounts, and statuses (Approved, Open, or Rejected).

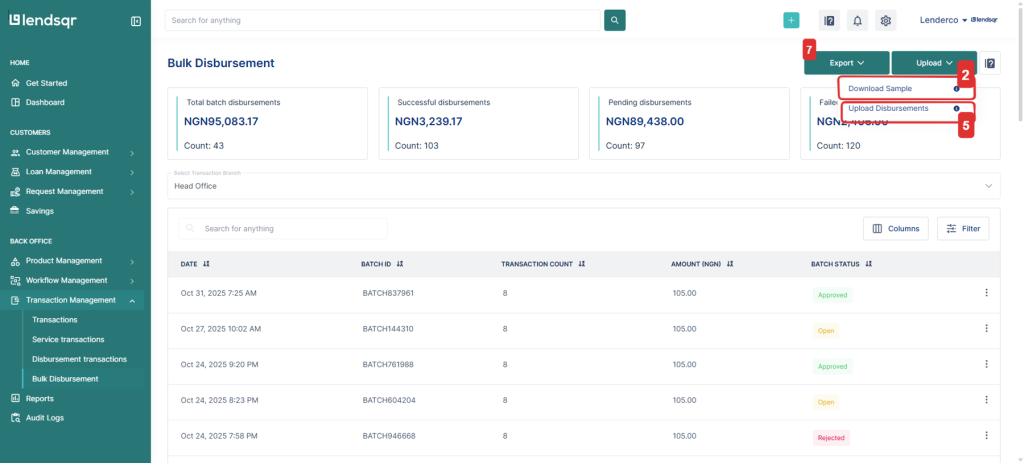

How to upload disbursements

To create and upload a new disbursement batch:

- Click the Upload button at the top-right corner of the page.

- Download the sample template — this shows the correct format for your upload.

- Fill in your disbursement details following the template’s structure.

- Save the file as an Excel (.xlsx) format.

- Upload the completed file.

- If your organization uses an approval workflow, the batch will automatically move through the required approval stages before final disbursement.

- You can also export bulk disbursement data at any time for record-keeping, reconciliation, or audit purposes.

Bulk Disbursement Template Format

Your Excel file should include the following columns exactly as listed below:

| Field Name | Description |

|---|---|

| customer_name | The full name of the customer receiving the disbursement. |

| phone_number | The customer’s mobile number. |

| bank_code | The unique code identifying the customer’s bank (e.g., 058 for GTBank, 044 for Access Bank). |

| bank_name | The customer’s bank name. |

| account_number | The 10-digit bank account number of the customer. |

| transaction_reference | A unique reference ID for tracking the transaction (e.g., TXN123456). |

| transaction_type | Type of disbursement. Examples: loan-disbursement, savings-disbursement, normal-disbursement, others. |

| user_id | The system user ID associated with the customer. |

| amount | The payout amount. |

| narration | Description or note for the transaction (e.g., “Loan payout for John Doe”). |

Tips for a Successful Bulk Upload

- Make sure all fields are filled accurately — missing or incorrect data can cause upload errors.

- Avoid duplicate transaction_reference values.

- Double-check account numbers and bank codes before uploading.

- Use clear, consistent narrations to make tracking easier.

- If a batch fails, review the error message, fix the data, and re-upload.

Tracking and Managing Bulk Disbursements

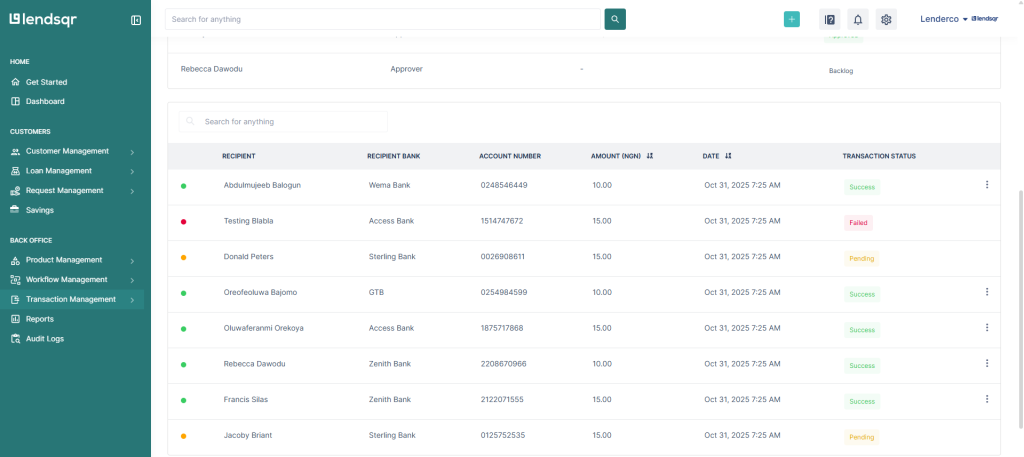

After upload, you can monitor your batches directly from the Bulk Disbursement page. Each batch will display its status:

- Approved — Successfully processed and completed.

- Open — Still pending or under review.

- Rejected — Requires correction or re-upload.

You can also click on a specific batch to get more details on the disbursement.

You can also filter, search, or export data to help with reconciliation and reporting.

Why Use Bulk Disbursement?

- Saves time and reduces manual errors

- Streamlines loan and savings disbursement processes

- Supports secure and traceable payments

- Works seamlessly with your existing approval workflow

- Provides full visibility into payout performance

Read more: How to use the column filter on every table on the admin console