Introduction: What is BNPL and Why It Matters

Buy Now, Pay Later (BNPL) is a lending model that allows customers to purchase goods or services immediately and pay for them either upfront (“Pay Now”) or in installments (“Pay Later”). With BNPL, lenders and merchants can provide flexible financing options that reduce barriers to purchase, improve customer satisfaction, and drive higher transaction volumes.

For lenders, BNPL is a proven way to:

- Extend credit directly at the point of sale.

- Attract and retain customers who value payment flexibility.

- Unlock new revenue streams from interest, fees, or merchant partnerships.

For customers, BNPL provides:

- Instant access to goods and services without large upfront payments.

- The ability to spread costs over time with manageable installments.

- Convenience and financial flexibility, especially for urgent needs (e.g., insurance renewals, subscriptions, or school fees).

Typical Use Cases for BNPL

BNPL can be deployed across multiple industries and customer needs. Common scenarios include:

- E-commerce: Let shoppers split payments on items such as electronics, clothing, or appliances.

- Insurance & Compliance: Help car owners and fleet managers pay for insurance or renewals instantly while spreading repayment over time.

- Subscriptions: Offer flexible monthly payments for streaming services, SaaS tools, or digital products.

- Education: Enable parents or students to spread school fee payments into smaller installments.

- Embedded Finance: Integrate BNPL into partner ecosystems, such as ride-hailing, logistics, or healthcare.

How BNPL Works on Lendsqr

Lendsqr provides a helper app (“Invitation”) that allows lenders and merchants to configure, embed, and launch BNPL products seamlessly on their websites.

Core Features

- Dual Payment Options: Customers can either pay in full (Pay Now) or spread payments (Pay Later).

- Configurable Loan Offerings: Lenders define product labels, descriptions, loan amounts, interest rates, and tenors.

- Customizable UI: BNPL settings allow you to configure button labels, switch options, and customer-facing messages.

- Identity & Security: Built-in account creation, bank account validation, and liveness checks ensure compliance and fraud prevention.

- End-to-End Flow: From product selection → loan scoring → offer acceptance → repayment scheduling → disbursement.

BNPL configuration settings explained

The configuration below defines how Buy Now, Pay Later (BNPL) works within the Lendsqr platform. Each section of the JSON enables or disables specific steps, labels, and flows in the BNPL journey.

Configuration Table

| Section | Key/Value | Explanation |

|---|---|---|

bnpl.enabled | true / false | Turns BNPL on or off. If false, customers won’t see BNPL options. |

bnpl.application_successful_message | String | Message displayed when a loan application is approved. |

bnpl.application_failed_message | String | Message shown when a loan application is declined. |

bnpl.pay_now.enabled | true / false | Enables the “Pay Now” (full payment) option. |

bnpl.pay_now.button_label | String | Text for the Pay Now button (e.g., “Pay in Full”). |

bnpl.pay_now.switch_to_pay_later | true / false | If true, lets users switch to installments. |

bnpl.pay_now.switch_to_pay_later_label | String | Label for the switch-to-installments option. |

bnpl.pay_now.payment_method | String | Payment method for Pay Now (e.g., bank). |

bnpl.pay_later.enabled | true / false | Enables the “Pay Later” (installments) option. |

bnpl.pay_later.button_label | String | Text for the Pay Later button (e.g., “Pay in Installments”). |

bnpl.pay_later.switch_to_pay_now | true / false | If true, allows switching back to Pay Now. |

bnpl.pay_later.switch_to_pay_now_label | String | Label for switching to upfront payment. |

bnpl.pay_later.payment_method | String | Payment method for installments (e.g., bank). |

title | String | Overall title of the loan/BNPL application screen. |

interest_rate | { label, description, enabled } | Defines whether interest rate is displayed and how it is described. |

interest_amount | { label, description, enabled } | Defines whether total interest is displayed. |

product_selection | { label, description, enabled } | Entry point for the customer to choose a product or amount. |

account_information | { label, description, enabled } | Captures customer registration details. |

loan_request_information | { label, description, enabled } | Collects loan amount and duration preferences. |

bank_account_information | { label, description, enabled } | Requests customer’s bank account for loan disbursement/repayment. |

identity_validation | { label, description, enabled } | Identity verification step for compliance and security. |

selfie_validation | { label, description, enabled } | Liveness/selfie check to ensure real user identity. |

order_information | { label, description, type, enabled } | Displays loan summary (amount, fees, schedule). Disabled in this config. |

terms_review | { label, description, enabled } | Step where the customer reviews loan terms. |

payments_processing | { label, description, type, enabled } | Shows repayment structure (amounts, dates, frequency). Disabled in this config. |

payment_methods | { label, description, enabled } | Allows user to select repayment method. Disabled in this config. |

authentication_setup | { label, description, enabled } | Step for creating password and PIN to authorize transactions. |

transaction_confirmation | { label, description, enabled } | Final confirmation before submitting the loan/BNPL application. |

equity_contribution | { label, description, enabled } | Initial upfront payment required before disbursement. Disabled in this config. |

Example BNPL configuration JSON

{

"bnpl": {

"enabled": false,

"application_successful_message": "You’ve successfully applied for your loan! We’re now reviewing your details and will notify you shortly with an update.",

"application_failed_message": "We're sorry, but your loan application wasn’t approved at this time.",

"pay_now": {

"enabled": false,

"button_label": "Pay in Full",

"switch_to_pay_later": false,

"switch_to_pay_later_label": "Prefer to pay in installments?",

"payment_method": "bank"

},

"pay_later": {

"enabled": false,

"button_label": "Pay in Installments",

"switch_to_pay_now": false,

"switch_to_pay_now_label": "Prefer to settle everything now?",

"payment_method": "bank"

}

},

"title": "Loan Application",

"interest_rate": {

"label": "Interest Rate",

"description": "This is the percentage charged regularly on the amount you borrow.",

"enabled": false

},

"interest_amount": {

"label": "Interest Amount",

"description": "This is the total interest you'll pay over the loan period, based on your loan amount and repayment duration.",

"enabled": false

},

"product_selection": {

"label": "Let’s Get Started",

"description": "Input the amount that best suits your needs and provide a few quick details to begin.",

"enabled": true

},

"account_information": {

"label": "Customer Registration",

"description": "Please provide your basic information. If you’re new here, we’ll help you set up your profile. If you’ve registered before, we’ll guide you to log in securely.",

"enabled": true

},

"loan_request_information": {

"label": "Loan Request Information",

"description": "Tell us how much you need and for how long. We’ll use this to customize your loan offer.",

"enabled": true

},

"bank_account_information": {

"label": "Bank Account Information",

"description": "Provide your bank details so we can process your loan and repayments securely.",

"enabled": true

},

"identity_validation": {

"label": "Identity Verification",

"description": "We verify your identity to keep your account secure and comply with regulatory standards.",

"enabled": true

},

"selfie_validation": {

"label": "Liveness Check",

"description": "Snap a quick selfie to confirm you're the real you. It’s fast, secure, and protects your account.",

"enabled": true

},

"order_information": {

"label": "Loan Summary",

"description": "Here’s a full breakdown of your loan, amount, fees, and repayment schedule. Please review before submitting.",

"type": "Loan Product",

"enabled": false

},

"terms_review": {

"label": "Review of Loan Terms",

"description": "Carefully go through the terms of your loan so you're fully informed before moving forward.",

"enabled": true

},

"payments_processing": {

"label": "Payments",

"description": "See how your repayments are structured over time, amounts, dates, and frequency.",

"type": "Repayment breakdown",

"enabled": false

},

"payment_methods": {

"label": "Payment Methods",

"description": "Choose your preferred way to make repayments.",

"enabled": false

},

"authentication_setup": {

"label": "Password and PIN",

"description": "Authorize your loan application by inputting your password and PIN.",

"enabled": true

},

"transaction_confirmation": {

"label": "Loan Confirmation",

"description": "Almost done! This is your final chance to confirm the loan details before we proceed.",

"enabled": true

},

"equity_contribution": {

"label": "Initial Payment",

"description": "A one-time upfront payment that helps lower your overall loan burden. This is usually required before disbursement.",

"enabled": false

}

}

Key Notes

- In this config, BNPL is disabled (

enabled: false). To activate, set it totrue. - Many important steps (like

product_selection,account_information,identity_validation) are enabled to ensure customer onboarding is smooth. - Some optional steps (like

order_information,payments_processing, andequity_contribution) are disabled here but can be turned on depending on business needs. - Labels and descriptions should be adjusted for clarity and brand tone.

Step-by-step guide

Follow these steps in the Admin Console to enable or update Buy-Now-Pay-Later (BNPL) for a loan product using the JSON you provided.

1. Log in to the Admin Console

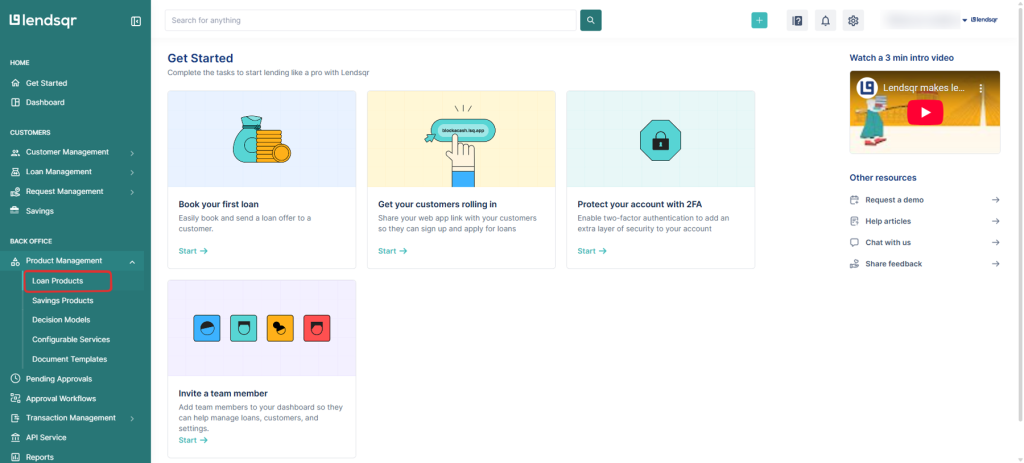

2. Navigate to Loan Products

From the main menu go to Product Management → Loan Products.

3. Create a new loan product or open an existing one

- If creating: click Create product and fill the required details.

- If editing: click the product from the list to open Product Details.

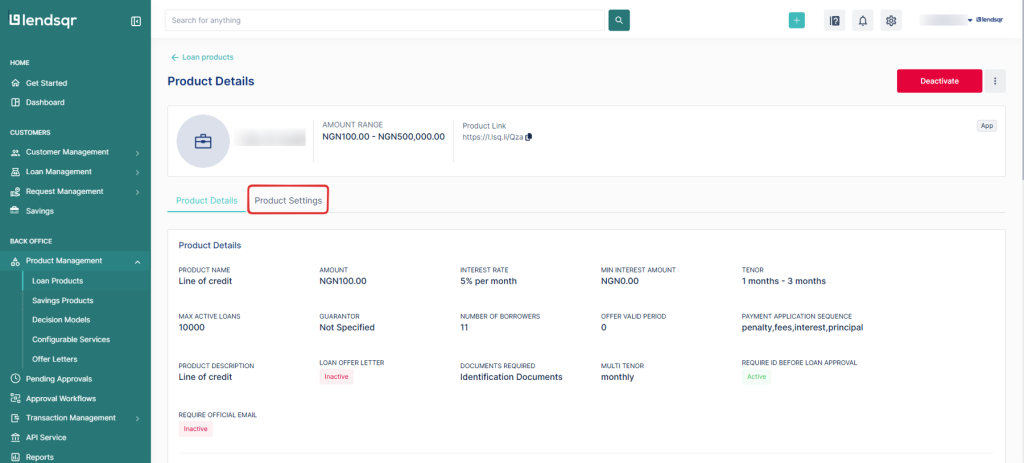

4. Open the Product Settings tab

On the Product Details page click the Product Settings (or Attributes) tab.

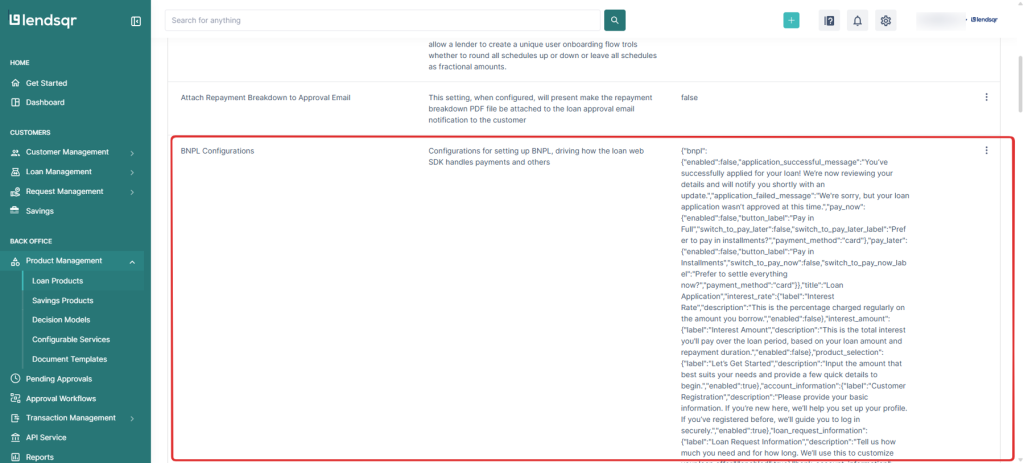

5. Locate the BNPL configurations attribute

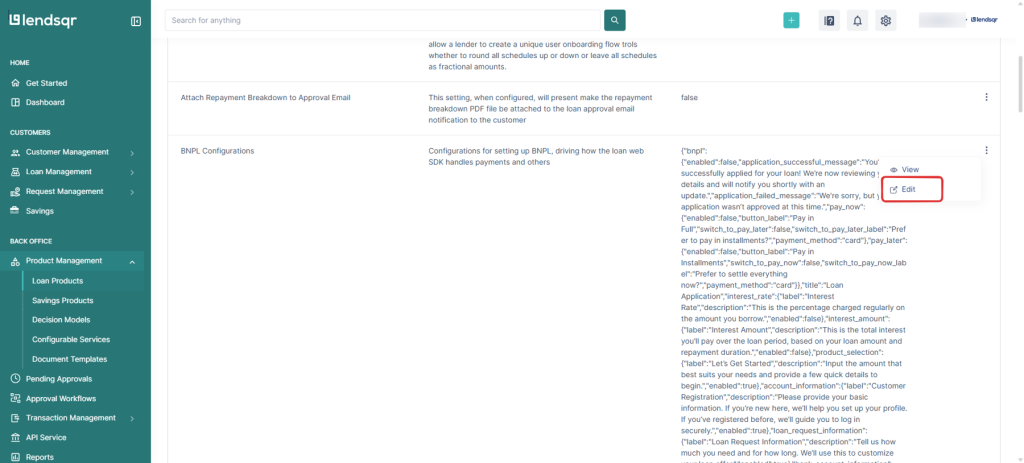

- Find the attribute named BNPL configurations.

- Click the three-dot menu (⋯) next to the attribute and choose Edit. This should open a modal where you can paste/update the config.

6. Update the JSON config and save

- Edit the bnpl object to match your business decisions (enable/disable Pay Now / Pay Later, button labels, messages, payment method).

- Validate the JSON (no trailing commas, proper quotes).

- Click Submit to apply the changes to the product.

- To copy an embeddable link, click here to learn more about to get your product link.

- To set up dynamic/multiple loan offerings on the product, click here to learn more.

- To set up equity contribution on the product, click here to learn more.

- To set up custom form i.e additional form fields to be collected for BNPL, use the Custom BNP Form Builder which works the same way as a regular custom form builder. Learn more.

Best Practices

- Always configure reasonable amounts and tenors to avoid errors or mismatches.

- Use equity contributions (initial payments) where appropriate to lower credit risk.

- Ensure all labels and descriptions are customer-friendly and consistent.

- Test both Pay Now and Pay Later flows before going live.

- Monitor customer adoption and refine product offerings for optimal performance.