Introduction

When a user submits a loan application on a Lendsqr-powered platform, it doesn’t get approved instantly. Instead, the request enters a preliminary stage where it is tagged with the pending loan status. This stage is crucial, as it represents the period during which the system, and in some cases, human reviewers carry out necessary checks before a final decision is made.

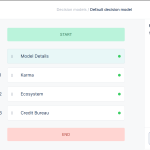

During this phase, the loan request is evaluated against multiple criteria such as credit history, risk score, employment details, identity verification, and any additional rules set by the lender. The system may rely on automated scoring models, external data sources like credit bureaus, and documents submitted by the user.

For example, if the loan product requires a valid ID and proof of income, the system verifies these documents as part of the evaluation. If anything is missing or flagged, the loan may stay in the pending stage until resolved.

The pending loan status does not mean that the loan has failed or been rejected. It simply means the decision is still in progress. Depending on the complexity of the lender’s rules or the completeness of the user’s application, this stage may take a few seconds or several hours.

Once all checks are complete and the loan is approved, the system automatically changes the status to “approved”. It then proceeds with disbursement if all conditions are met. If any issues are found, the status may switch to “declined” instead.

Understanding this status helps both lenders and users stay informed about what’s happening behind the scenes during loan processing.

Read further: Understanding loan statuses

Also read: 5 reasons why you should embed credit into your products and services