A line of credit (LOC), sometimes referred to as an overdraft, gives your customers more flexibility than a traditional loan. Instead of disbursing a fixed amount upfront, a line of credit allows borrowers to draw funds up to a set limit whenever they need it, and only pay interest on what they actually use.

This makes it an excellent product for customers with recurring short-term needs or businesses that want cash-on-demand without reapplying for loans multiple times.

In this guide, we’ll walk you through how to set up a line of credit product directly from the Lendsqr admin console and ensure it’s ready for your customers.

Why offer a Line of Credit?

Before diving into setup, here’s why lenders are increasingly adding this product to their portfolio:

- ⚡ Flexibility for borrowers – customers can access funds as needed, rather than taking one lump sum.

- 💰 Pay for what’s used – borrowers pay interest only on the portion they actually draw.

- 📈 Customer loyalty – offering an overdraft builds stickiness, since customers are more likely to stay with lenders who give them adaptable credit solutions.

- 🛠️ Efficiency for lenders – fewer repeat loan applications and faster turnaround times.

Step-by-step guide

1. Login to the Admin Console

2. Click on “Loan Products” under “Product Management“

3. Create a loan product or open an existing one

Line of credit only works for products configured with disburse to set to ‘wallet’.

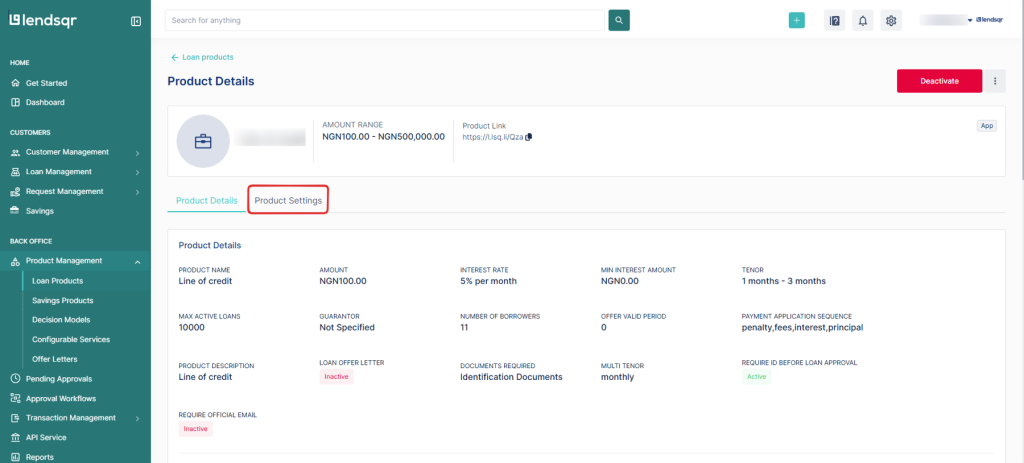

4. Click on the “Product Settings” tab on the “Product Details” page.

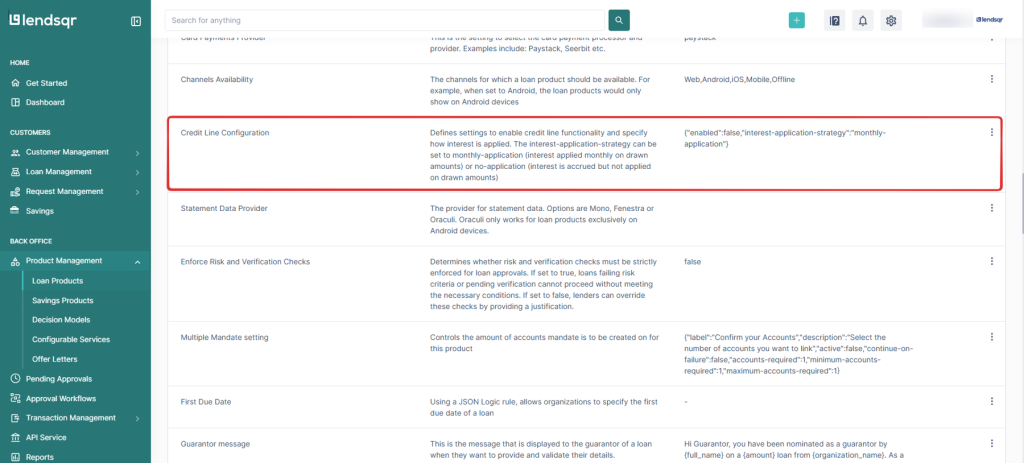

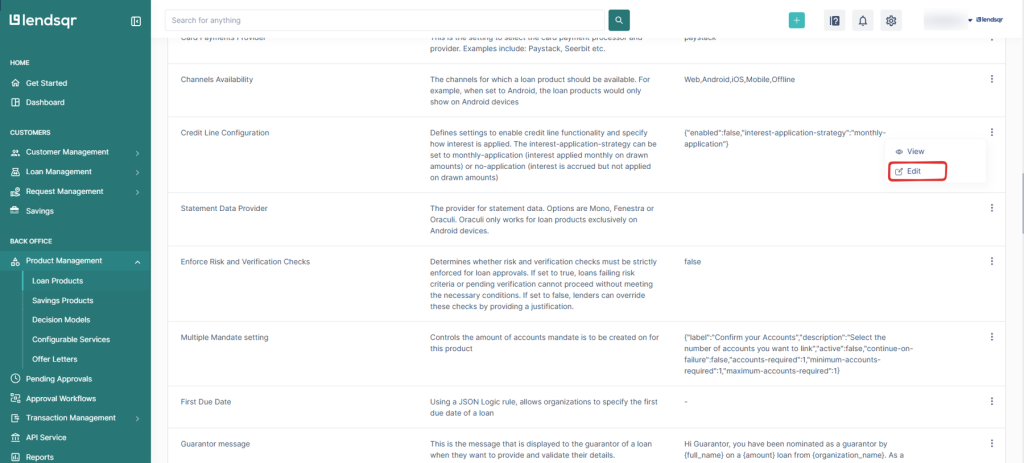

5. Locate the “Credit Line Configuration” setting. Click on the “three dot” icon and select “Edit” beside this setting. By default, this setting is disabled.

6. To enable credit line, check the box Enabled to activate credit line functionality for this product., and click on the “Submit” button to apply the changes to the product.

7. Select Interest Application Strategy: This is where you define how interest will be applied to drawn amounts. You have two options:

- Monthly-application ✅: Interest is applied at the end of each month on the amount the customer has drawn. Example: If a customer has a ₦500,000 credit limit but only draws ₦200,000 in September, interest will only be charged on the ₦200,000.

- No-application: Interest is accrued but not formally applied to the drawn amount each month. Typically used when lenders want to defer interest application to a later date, such as at final settlement.

👉 Best Practice: Most lenders prefer monthly-application since it keeps repayment schedules clear, predictable, and manageable for customers.

8. Once you’ve selected your strategy, click Submit. Review your configuration carefully and confirm to save changes.

Your loan product is now configured as a Line of Credit (Overdraft)!