At lendsqr, we understand the importance of collecting comprehensive data from borrowers to make informed decisions with a custom form.

For this reason, we’ve enhanced our system to ensure all required custom form questions are answered before manually booking a loan.

Step-by-step guide

Configuring your loan product with a custom form

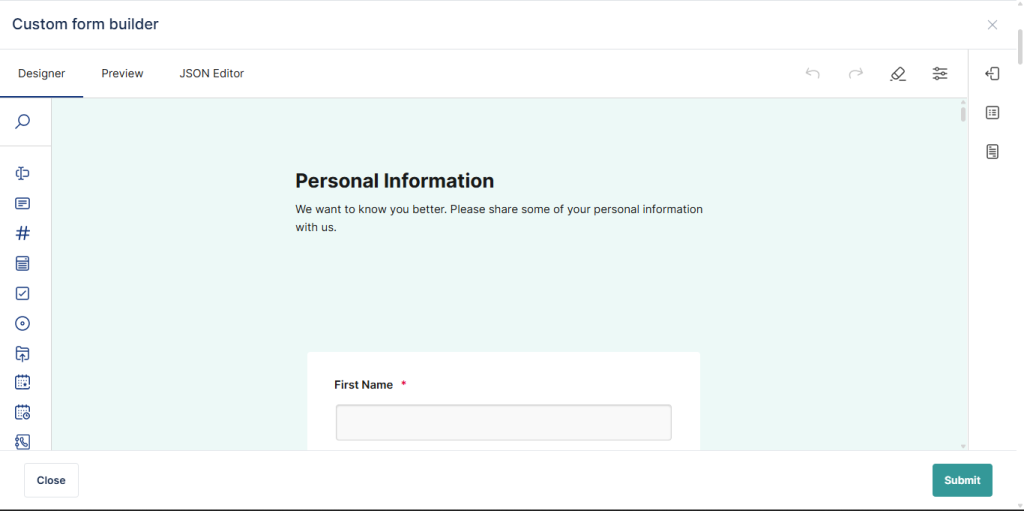

To enable custom form questions and allow offline loan booking, firstly, you need to modify specific product attributes:

- Custom form builder: This is where your custom or additional questions are stored in JSON format. Here is an example:

{

"meta": {

"name": "<org name>",

"description": "This is a customized loan application flow for <org name>",

"version": "1.0",

"url": "https://www.example.com",

"status": "active"

},

"pages": [

{

"name": "Page 1",

"title": "Page 1 Details",

"description": "Sample description",

"actions": [

{

"type": "continue",

"label": "Continue"

},

{

"type": "cancel",

"label": "Cancel",

"message": "Are you sure you want to cancel this loan request?"

}

],

"sections": [

{

"name": "Section 1",

"description": "Section 1 description",

"fields": [

{

"id": "short_text_field",

"name": "Short Text field",

"type": "short_text",

"label": "Short Text field",

"description": "Short Text field Description",

"validation": {

"required": true,

"minimum_length": 1,

"maximum_length": 256

}

},

{

"id": "select_field",

"name": "Select Field",

"type": "select",

"label": "Select Field",

"description": "Select Field Description",

"validation": {

"required": true,

"multi_select": false

},

"options": [

{

"label": "Option A",

"value": "Option A"

},

{

"label": "Option B",

"value": "Option B"

},

{

"label": "Option C",

"value": "Option C"

}

]

}

]

}

]

},

{

"name": "Page 2",

"title": "Page 2 details",

"description": "Sample description",

"actions": [

{

"type": "submit",

"label": "Submit"

},

{

"type": "cancel",

"label": "Cancel",

"message": "If you cancel this, all the information you have provided will be discarded. Are you sure you want to do this?"

}

],

"sections": [

{

"name": "Section 1 in Page 2",

"description": "Sample Description",

"fields": [

{

"id": "phone",

"name": "Phone",

"type": "phone",

"label": "Phone",

"description": "Details",

"validation": {

"required": true

}

},

{

"id": "number",

"name": "number",

"type": "number",

"label": "text number field",

"description": "description",

"validation": {

"required": true,

"minimum": 10,

"maximum": 9999999999

}

}

]

}

]

}

]

}- Channel visibility: Select where the loan product is visible.

- Login to the admin console and navigate to “Loan Products” under “Product Management“. Once logged in, locate the side navigation and click on “Product Management.” After that, in the dropdown menu, select “Loan Products.“

3. To create a new loan product, firstly, click on the “Create Loan Product” button.

- To update an existing product, find the product in the list and click on the “Edit” button next to it.

4. Locate the “Custom Form Builder” attribute and then, click the “Edit” button. Copy and paste your custom questions in JSON format into the code editor and then, save your changes.

5. Find the “Channel Availability” attribute and click “Edit“. Now, add “Offline” to the list of channels and save your changes.

Now, ensure your loan product is activated before moving to the next section. Learn more

Booking a loan

1. Firstly, initiate a new loan booking and click on the “Quick Create (+)” button on the top navigation pane. After that, select “Book a Loan.”

2. Enter the user’s BVN and select the previously configured product. However, the form will autofill with the additional questions. Complete all fields and click “Book New Loan.”

3. Click on the “View Loan” button to view loan details.

As a result of this feature, agents can avoid errors during loan setup and ensure every application meets the lender’s criteria. Furthermore, this speeds up the review process because complete information allows for quicker decision-making.

In addition, the update improves accuracy, reduces delays, and enhances the overall customer experience. Ultimately, these enhancements make the loan booking process smoother, faster, and more reliable for both agents and customers.

Also read: Earn extra income by helping businesses access better lending solutions