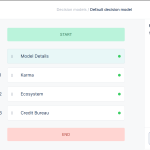

On the Lendsqr platform, a user’s eligibility for a loan is determined by rules set by the lender. These rules are part of a customizable decision model that uses hundreds of data points to assess whether a user is eligible or not.

How eligibility works

Each lender has the flexibility to define what makes a user eligible for a loan. These criteria may include:

- Credit score or financial behavior

- Employment status or income level

- Loan history and repayment behavior

- Identity verification or KYC status

- Number of active loans, among others

When a user applies for a loan, the system checks their information against these predefined rules. If the user fails to meet one or more of the conditions, they are marked as not eligible, and the loan request is automatically declined.

A lender can easily find out why a loan has been declined by the system.

Why some users are not eligible

A user may not be eligible for several reasons:

- They have poor or limited credit history

- Their income does not meet the minimum requirement

- They have an outstanding or unpaid loan

- Their KYC is incomplete or unverifiable

- The lender’s decision model has strict risk criteria

Also read : How to set up CRC Credit Bureau for Lendsqr