Decision data refers to the diverse set of information supplied to the decision model during a loan assessment process. This data helps lenders evaluate a borrower’s creditworthiness with a high degree of accuracy and automation.

For instance, when a borrower applies for a ₦500,000 loan, the system automatically pulls together all relevant decision data: the borrower’s stated employment details, geolocation from their device, Karma on the Lendsqr ecosystem, credit history from the bureau, and financial behavior from bank statements. This comprehensive data profile enables the system to make a confident decision approving the loan at a competitive rate without the need for a guarantor.

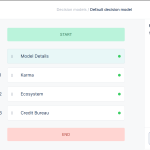

The data points used typically come from the following sources:

- Borrower-provided information such as address, income, and place of work.

- Device data like location and telemetric signals, which help verify activity and reduce fraud.

- Internal ecosystem data including Karma and repayment behavior from loans with other Lendsqr-powered lenders.

- Third-party sources such as credit bureaus or external blacklists.

- Analytics engines like Lendsqr’s ML model or partners such as Periculum, which generate behavior-based scores.

- Banking data derived from transaction records or statement analysis.

By combining all these sources in real time, the Lendsqr decision engine enables smart, fast, and fair loan assessments, ensuring both risk control for the lender and a seamless experience for the borrower.

Also read: How the Lendsqr Karma service blocks bad actors and defaulters – Lendsqr