Sometimes, a loan gets disbursed successfully, but the customer does not withdraw the funds from their wallet. This could happen for a variety of reasons, perhaps the user changed their mind, didn’t complete verification steps, or simply overlooked the disbursement.

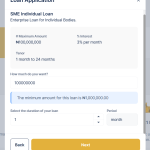

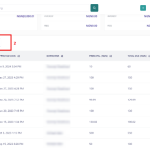

When this happens, Lendsqr provides a straightforward solution. From the admin console, an authorized admin can reverse the loan. However, before the reversal takes place, the system performs a crucial check: it verifies that the full loan amount is still sitting in the user’s wallet and that no portion of it has been withdrawn or used.

If the check confirms that the funds are untouched, the admin can proceed with the reversal. Once this action is completed, the loan status updates to “reversed.”

This process helps lenders maintain financial accuracy and ensures that unused disbursed loans do not reflect as outstanding liabilities on the system. Moreover, it protects both the user and the lender from unnecessary interest accruals or repayment confusion.

To summarize:

- A loan can be reversed only if the full amount remains unused in the wallet.

- The system automatically verifies the wallet balance before allowing a reversal.

- An admin can execute the reversal from the Lendsqr admin console.

- The loan status becomes “reversed” once the process completes.

By enforcing these checks, Lendsqr ensures loan management remains clean, traceable, and accurate.

Read further: We’re giving our lending tech away for free to non-profits and DFIs