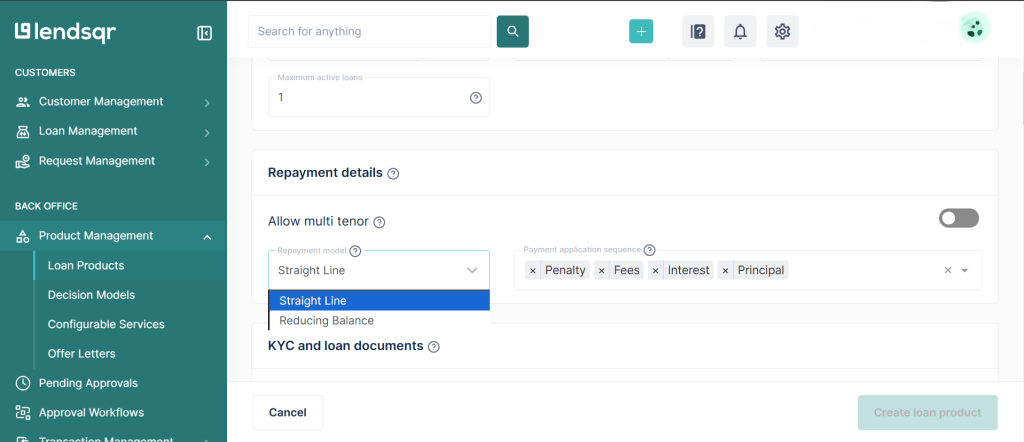

What is straight line and reducing balance?

Straight Line and Reducing Balance are two common loan repayment methods that determine how interest is charged and how borrowers pay back their loans.

How these repayment methods work

With straight line repayment, the interest on the loan is calculated equally per period, the Equated Monthly Installment (EMI) is the same, and the same component of interest is payable for each period. This means that interest is charged on the full loan amount throughout the loan period, regardless of how much has been paid back. So, the monthly payment stays the same; part interest, part principal.

The reducing balance method calculates interest at periodic intervals on the amount of the principal not yet repaid. While the repayment amounts, EMI are equal, the interest component of the EMI is larger in the initial repayments and gradually reduces over time when compared to the principal amount. In simpler terms, reducing balance calculates interest on the remaining loan balance. So, as the borrower repays, the interest portion of each installment reduces over time.

For the reducing balance method, even though periodic EMI repayments amounts do not change, the proportion of principal and interest components changes with time. With each successive repayment, more is allocated towards the principal and less towards interest. So, even though your monthly payment doesn’t change, what it’s made up of (interest vs. principal) does change, with more going toward paying off the loan balance (principal) as time goes on.

Let’s say you borrow $1,200 for one year at 12% interest. With the straight line method, you pay 12% of the full $1,200, so $144 in interest split evenly over 12 months ($12 per month), making your monthly payments $112 ($100 principal + $12 interest). With the reducing balance method, interest is charged only on what you still owe, so your first month’s interest can be 1% of $1,200 ($12), but the interest reduces each month as you pay down the loan. This means your monthly payments start slightly higher but decrease over time, and you end up paying less total interest, around $78 instead of $144.

When giving out loans, choosing the right repayment method matters both for the lender and the borrower. The straight line method charges interest on the full loan amount throughout the loan period, while the reducing balance method calculates interest on the remaining loan balance, so the borrower pays less interest over time, even though the monthly payments stay the same. Understanding the difference between the repayment methods will help you design fair loan products and helps borrowers make smarter financial decisions.

Find out more ways to improve your loan repayments here.

Also read: Which is better for loan repayments: Cards or Direct Debit?