What are decision models?

Decision models are the rules and logic lenders use to automatically assess and approve or reject loan applications. Instead of reviewing each request manually, a decision model helps instantly decide based on set criteria like credit score, income, or loan history.

On the Lendsqr platform, decision models make lending faster, smarter, and more consistent. You can build custom models that reflect your risk appetite and lending strategy. For example, you might create a rule that says “Approve loans under $500 if the applicant has no unpaid loans and earns over $1,500 monthly.” This way, every application is judged fairly, reducing fraud, improving efficiency, and helping you lend with confidence at scale.

The engine behind our decision models, Oraculi has a number of modules through which we can determine whether a borrower poses a risk with respect to proprietary weights attached to certain data points provided by the users, as well as their activities across various lenders on our ecosystem.

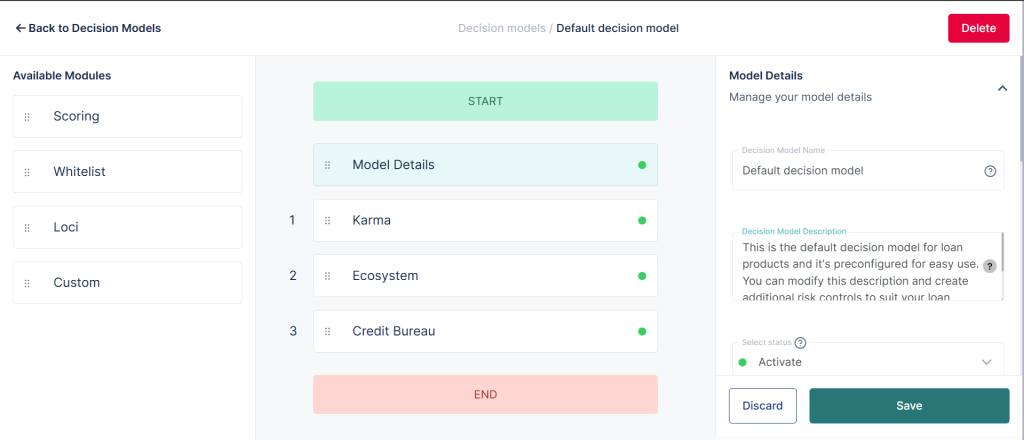

Oraculi decision models help lenders automatically assess whether a borrower qualifies for a loan and what kind of offer they should receive. The model combines two key parts: the decision checks (called decision modules) and the loan offer settings. The decision modules handle all the background checks like credit score, income, or existing loans, while the offer settings determine the loan terms presented if the borrower passes those checks.

Each module can be customized to match your lending rules, and the results are displayed as Decision Data on the user’s loan profile, making it easy to understand how the decision was made. For example, if a borrower meets all the criteria set in the decision modules, the system might automatically offer them a $1,000 loan at 3% interest over 3 months, all without manual review.

Watch the video below to learn more about decision models

Click here to learn more about decision model settings.

Also read: How we built Oraculi to help lenders make informed decision