A cooperative society uses Lendsqr to offer salary advances to its verified members. Since the group already runs monthly payroll deductions, they use the Whitelist Prequalification feature to instantly approve their members without re-evaluating credit risk. This saves time and ensures seamless loan disbursements.

By using Lendsqr’s Whitelist Prequalification, lenders can streamline loan approvals for trusted customers while maintaining a clear audit trail of all whitelisting actions.

What is Lendsqr’s whitelist prequalification?

Lendsqr offers a Whitelist Prequalification feature that allows lenders to approve specific customers for loans without subjecting them to the standard risk assessment criteria and decision models. This is especially useful when a lender already trusts the borrower, such as employees of a known organisation, loyal customers, or referrals from verified partners.

Through the Lendsqr Whitelist, lenders can override their usual credit models and directly mark customers as prequalified. This enables faster disbursement, better user experience, and more control over who receives credit.

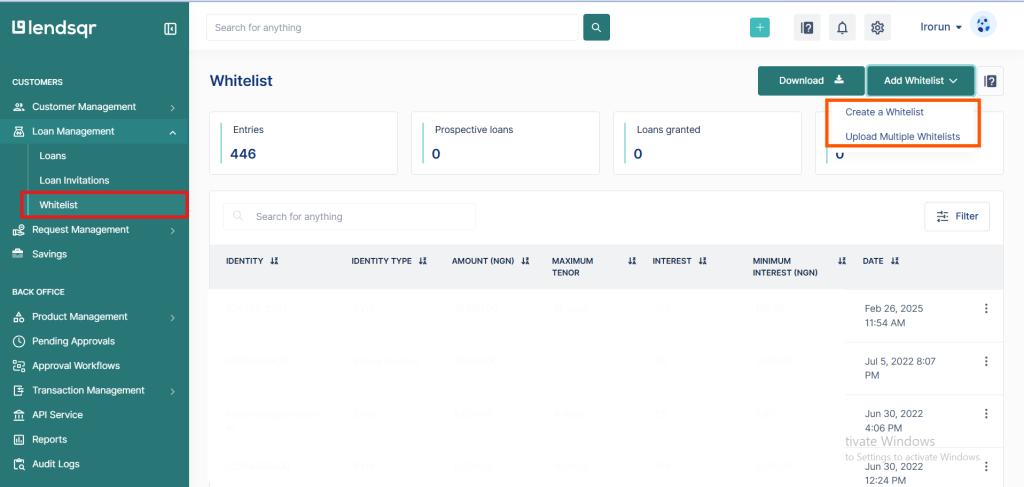

Lenders can prequalify customers in two ways:

- Individually: By entering the customer’s details (such as phone number or BVN) directly on the Lendsqr console.

- In bulk: By uploading a preformatted CSV template that contains multiple customer entries.

The Whitelist module is located in the side navigation bar of the Lendsqr admin console and is easy to access and manage.

By using Lendsqr’s whitelist prequalification functionality, lenders can streamline loan approvals for trusted customers while maintaining a clear audit trail of all whitelisting actions.

Read further: Should I lend to this customer? A guide to risk assessment