The KYC process of a country refers to the regulatory process used by this country to verify user identity in line with compliance standards.

This is done to prevent fraud and terrorism financing, while also verifying user authenticity.

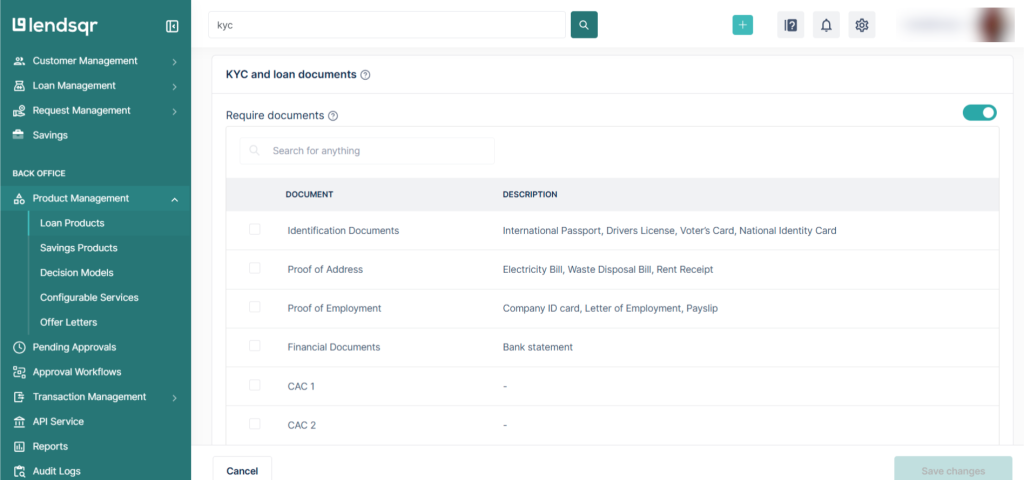

Documents are usually used to verify customers. The documents you would require of your customers would be a function of the countries in which you operate.

For example, if you are a Nigerian lender using the Lendsqr platform, it is expected that you serve Nigerian borrowers. In this case, the KYC process must be verified using either of the following documents:

- National Identification Number (NIN)

- Bank Verification Number (BVN)

- Driver’s License

- Voter’s Card

- International Passport

If in doubt of how to go about this, consult the regulator for the country in which you operate.

Also read: Why Lendsqr is Africa’s most affordable loan management software